January 28, 2025Fourth Quarter 2024

Dear Client,

The fourth quarter of 2024 has ended and enclosed you will find your personalized quarterly performance report as of December 31st.[1] This letter will provide an explanation of overall NorthStar portfolio performance relative to our benchmarks. We are happy to review your individual account upon request. If your investment objectives, risk tolerance, or overall financial situation has changed, please contact us immediately.

The Gulf of America

A cartoon submitted to the Washington Post by a staff cartoonist early this year portrayed Elon Musk, Mark Zuckerburg, Jeff Bezos, and other tech bros bowing down to an enormous Donald Trump. The cartoon was nixed by the Post (owned by Bezos); we assume this was because Bezos was shown in a bad light. The cartoonist quit.

The cartoon is apt—but, in our minds, it misses another point. It is Donald Trump who should be portrayed kissing the feet of the wealthy tech CEOs who helped him secure his victory. These techies saw an opportunity and seized it, showing us exactly who they really are. Their allegiance to Trump did not come from some recent awakening, it exemplifies and reveals their capitalist drive at its most selfish; these tech bros are out for themselves. It is Donald Trump, a like-minded narcissist, who will grease the wheel of unregulated growth, and he couldn’t have been elected without their followers. Trump has been played. The support of JD Vance from out of nowhere was a key part of the plan for unbridled access, and the campaigning and campaign funds that would follow were no doubt the carrot that solidified the connection to Trump.

We believe the exponential and potential growth, reach, and use of artificial intelligence (AI) is the wave that is pushing these folks forward. Space travel, the search for “special earths” for computing, the takeover of the Panama Canal, Greenland, Canada (?) are all a part of the plan, we suspect, to build sufficient infrastructure to cool the data centers and control competition that will be necessary for this anticipated growth. The horse is out of the barn, and, while many elected officials have claimed to be all about the little guy who wants America to be great again, we believe these tech titans will be running the show, and their dollars will control the elections and the subsequent deregulation. As an example, here is an article that speaks to the impact that private wealth and power can have on a community: https://www.propublica.org/article/elon-musk-boring-company-las-vegas-loop-oversight.

There has been tremendous appreciation in the S&P 500 and the NASDAQ in the last two years. As you have heard from us in meetings and writings, most of the price appreciation has come from seven of the 500 S&P companies in reaction to the explosion of generative AI. We have participated in some of the growth (Apple, Google, Microsoft), but we missed the largest winner, Nivida, and opted out of the companies led by the tech bros mentioned above (Amazon, Tesla, Facebook) due to our very specific concerns about the CEOs (among other concerns). This is not to wholly commend the corporate structure, leadership and behavior of the other three, but our engagements with them as well as their intersection with AI, Cloud, chip and their diversified technological development strength have played an important role in the portfolio.

As we navigate this next chapter of our political and economic lives, especially considering AI, we must and will continue to consider the impact of this technological wave on the living creatures of the world, humanity included. We will focus as we have on the solutions to addressing our aging demographic, our fragile ecosystem, and the ever-expanding chasm between the haves and the have nots. We will look to AI developments that we believe can be beneficial and remain vigilant as we face the economic and social challenges that will come from poorly designed or short-sighted solutions to “growth.”

Update on Economic Outlook and NorthStar’s Strategy

Q4, 2024: Sticky inflation and resilient economy leaves Fed in a pickle

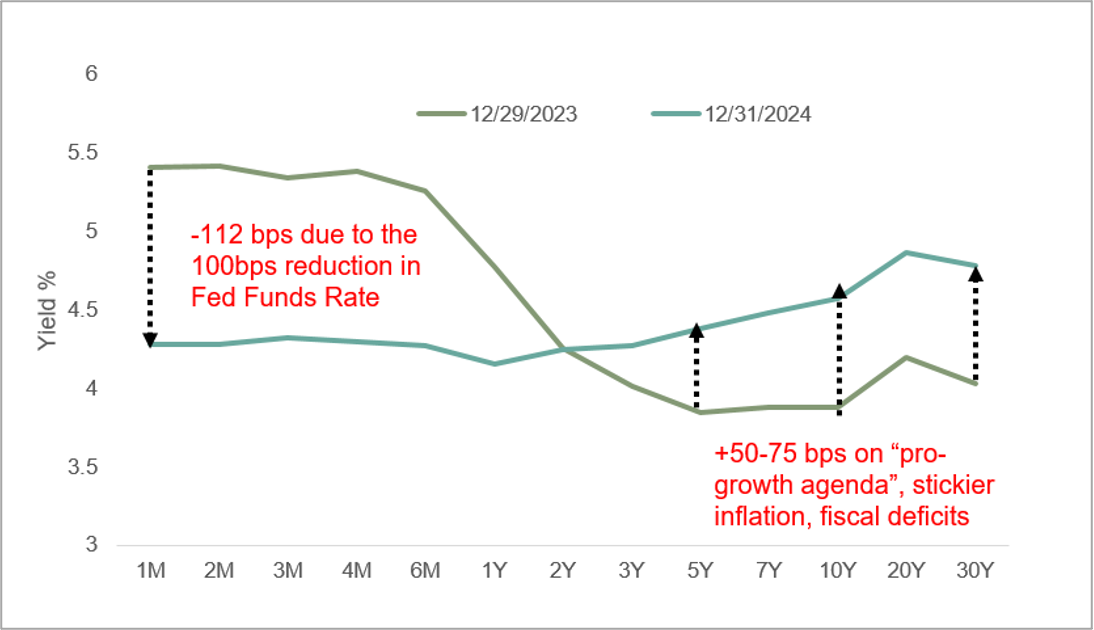

The Federal Reserve Bank (Fed) reduced the federal funds rate target (FFR) by 25 basis points to 4.25-4.50% on December 18, bringing its full-year 2024 reduction to 100 basis points (1%). However, interest rates for longer-term bonds (maturities greater than two years) increased, counteracting the Fed’s intention to bring interest rate relief to younger and lower income consumers and small businesses. This upward move in long-term rates may reflect optimism that the incoming Trump administration’s anticipated tax cuts and deregulation agenda will boost economic growth. At the same time, bond investors may be concerned about rising government debt and demand higher yields to compensate for increased risk. In announcing the rate reduction, Chairman Powell signaled a slower pace of future reductions due to uncertainty on inflation and economic outlook. Markets typically prefer easier monetary and credit conditions to stimulate economic activity, so this cautious approach to further reducing short-term interest rates has contributed to a wobble in the equity markets.

US Treasury Yield Curve

2024: Equity markets post another year of strong returns amidst technological, political, and regulatory disruption

U.S. markets experienced double-digit returns in 2024, driven, we believe, by a confluence of factors including solid earnings reports, healthy economic data, the monetary easing cycle, and anticipation of a pro-growth agenda from the incoming Trump administration. The Nasdaq posted ~30% gains fueled by excitement and investments surrounding the adoption of Artificial Intelligence (AI) technologies. European markets rose 2.7% in response to muted economic growth. Political instability in Germany and France also weighed on the sentiment in our view. Japan posted double digit returns in local currency (9% in USD).

Macro Picture

Decade of US Outperformance

These positive returns may mask the reality of what we believe are extreme technological, political, and regulatory disruption that our society is confronting. The public launch of ChatGPT in November 2022 and its unprecedented adoption by a million users within five days ignited a global frenzy around artificial intelligence. Driven by the surge of investments in power-hungry data centers to support AI models, official forecasts for increases in electricity demand through 2029 have risen from 2.8% to 16% in just two years (2022-2024)[2]. In a matter of months, we have shifted from a world talking about transition from fossil fuels to one in which new gas plants are emerging and mothballed nuclear plants may be restarted. Meanwhile, we believe the unpredictability of Trump’s policies on everything from trade tariffs to taxes is creating uncertainty in both financial markets and everyday life. This economic uncertainty is unfolding against a backdrop of growing wealth inequality, with 58 million people (1.5% of the world’s population) owning roughly 50% of global financial resources[3]. In public markets, the so-called “Magnificent Seven” stocks contributed 55% of the S&P 500 gains in 2024[4], and revenue and earnings growth for this cohort has far outpaced the growth of the remaining public companies. The decade of US exceptionalism continues with strong but concentrated relative performance of U.S. equities and the U.S. economy compared to the rest of the world.

As we have often noted, our approach to navigating what we feel are treacherous moments is to ensure that we understand your financial needs and objectives and establish an appropriate target asset allocation and liquid reserves. Secondly, we remain disciplined and committed to strategic asset allocation, maintaining appropriate diversification, and managing risk.

Selectivity in adding Fixed Income Exposure

We believe there is a high probability that interest rates will remain at current or higher levels over the mid-to-long term, as our government and others will need to fund Social Security, Medicare, and Defense programs while grappling with challenges related to ecological limits and socio-political upheaval. Since the beginning of this year, yields on 10-year bonds have see-sawed from a low of 3.6% to a high of 4.7% in response[5] to economic and inflation data points. We have maintained our discipline of buying bonds only when we believe yields are at attractive levels.

Where appropriate, we will continue to diversify across duration and add government bonds in the one to ten-year maturity range to our clients’ portfolios. We believe that bonds in this maturity range offer an optimal combination of flexibility, higher income returns, and stability for the portfolio.

High quality stocks with low debt can still provide long-term growth

Over the mid-to-long term, companies with low financial debt and that make products or sell services that we believe are beneficial to human life and that solve or mitigate some of the most pervasive problems of our time are likely to continue thriving. We focus our research on companies providing solutions and products to cope with:

- Ecological Limits: We believe our planet’s resources are increasingly under threat from ecological imbalances and decades of extractive growth.

- Aging and changing demographics: The world’s population aged 60 and over is growing faster than all younger groups and is expected to reach 1.4 billion by 2030, up from 1 billion in 2020.[6]

- Leveling the playing field: Digital transformation and new business models are enabling small businesses and entrepreneurs to compete with big business.

We aim to own and add stocks that offer competitive returns and diversification while also providing opportunities to create the greatest impact by changing corporate behavior via our shareholder activism work.

As a refresher, our investment strategy for the global equity portfolio involves independent research into each company’s growth prospects and financials combined with diligently examining the ethics of management and company behavior. The resulting portfolio, we believe, is more resilient, sustainable, and stable because of our broad-based focus. In addition, we follow our systematic quarterly rebalancing strategy in which we trim individual stocks that we feel are well past their target weights and reallocate to stocks that are under their target levels. Of course, past performance is not an indicator of future performance, and all investing involves risk!

Full Year 2024 Performance [7]

The U.S. aggregate bond index eked out a small gain despite a 100-bps reduction in the Federal Funds Rate as long-term yields increased in anticipation of higher growth and higher fiscal deficits. NorthStar’s fixed-income portfolios outperformed the intermediate-duration fixed-income benchmark due to a specific mix of treasuries, agency and green bonds, and CDFI notes. Our approach to selectively adding fixed-income exposure with what we feel were attractive yields also paid off.

The equity portions of NorthStar clients’ portfolios underperformed the MSCI All Country World Index, which posted a 17.5% return for the year. Our relative underperformance can be summarized in two distinct categories: 1) not owning four (Nvidia, Tesla, Amazon, Meta) of the Magnificent Seven, which hurt our relative performance by 370 basis points and 2) our underweight in big money center banks (J.P. Morgan, Goldman Sachs) and insurance companies which we feel benefitted from the Trump win and anticipation of broad based de-regulation activity. We recognize that we are in the early innings of what we believe will be an artificial intelligence fueled investment cycle. Many of our portfolio holdings (Microsoft, Alphabet, Apple, Schneider, Eaton, Digital Realty) will likely directly benefit from the growth in artificial intelligence expenditures and broad-based adoption of this technology, and we continue to further our understanding of the artificial intelligence value chain and look to add to and diversify our exposures through 2025.

NorthStar Global Equity Portfolio Stock Commentary[8]

| 12/31/23 – 12/31/24 | |||

| Top Performers | Bottom Performers | ||

| Company | Total Return (IRR) | Company | Total Return (IRR) |

| Sprouts Farmers Markets | 160.9% | Idexx Labs | -25.6% |

| Costco Wholesale Corp | 45.1% | Adobe Systems | -24.8% |

| Eaton Corporation | 44.4% | Straumann Holding AG | -21.4% |

| Badger Meter Inc. | 41.2% | Infineon Technologies AG | -21.2% |

| Alphabet Inc Cl A | 38.8% | Kubota Corp ADR | -20.0% |

Source: Axys/Advent

Note: IRR calculation is net of fees [9].

Sprouts reported acceleration in comparable and total sales growth throughout 2024. This business momentum enabled management to raise guidance over three consecutive quarters for FY24, with projected total sales growth of 12% vs. the 5.5-7.5% set earlier in the year. Comparable sales growth accelerated to 8.4% in Q3 vs. A 3% range in 2023. The Sprouts Brand, in our opinion, contributed to strong sales and now accounts for 22% of total sales. The company also expanded gross margins on improved inventory management, optimization of promotional activity, and sales leverage.

Costco outperformed as the retailer’s focus on value and quality supported robust comparable and total sales growth. Costco continues to gain market share across its various segments, especially e-commerce, international, and among higher-income consumers. Despite inflationary pressures, we believe Costco is proactively investing in its employees and prioritizing a fair and timely process in negotiations with the Teamsters Union. Management noted the company has a 40-year history of fair dealings with the Teamsters Union as evidenced by the fact that the average wage at Costco across the US and Canada is now north of $30 an hour.

Idexx underperformed our expectations as the company lowered guidance over three consecutive quarters, citing continued macro and sector-specific headwinds. Severe weather events also appeared to cause a decline in vet visits. Longer term, we believe Idexx should benefit from continued humanization of pets which typically leads to higher spending on pet care. Idexx has continued to invest in software and diagnostic solutions for early disease detection and stickier revenue streams for clinics. The company’s latest innovation is Cancer Dx, the primary panel for canine lymphoma, slated for launch in 2025. The panel is set to expand over the following three years to cover most canine cancers. Management estimates the market opportunity at $2.5B, citing that over one in four dogs die from cancer, current detection and intervention for canine cancer is usually too late to reverse disease, and breeds at more risk are increasingly popular (bulldogs, labradoodles, etc.).

In direct response to our view of high levels of disruption in the public markets, we are intentionally diversifying our portfolio holdings. We recently added three new names to the portfolio and eliminated two holdings:

December 2024 Portfolio and Markets Review – Transactions Summary

| Transaction Type | Company | Description | Action / Position (%) |

| Sales | Safety Insurance

|

Safety Insurance, headquartered in Boston, provides home and auto insurance for residents of Massachusetts, New Hampshire, and Maine. Growth has been subdued due to rising competition. Increased frequency of weather events makes the business model less resilient and hence we have exited the 1.35% position.

|

Exited – 1.35% |

| Sales | American States Water

|

American States Water provides water service to 10 counties in CA and electricity to the Big Bear Lake community. The company also has a growing portfolio of water and wastewater services to 12 military bases under long term contracts with the US government. Revenues from electricity production distribution exceed our materiality threshold of 5%. We are also concerned about the long-term risks related to water scarcity issues in California. | Exited – 1.1% |

| Purchases | Winmark: The Resale Company

|

Portfolio company of five secondhand retail brands including Plato’s Closet and Play it Again Sports. The business model aligns with our focus on promoting a circular economy. Consistent recurring revenue with high cash returns and low debt. | Target Position (over 3 Qtrs) – 1% |

| Purchases | Broadridge

|

Provides technology-based outsourcing solutions to financial services clients. Broad range of solutions including investor communications, trade processing, and back-office operations. The business model is geared towards shareholder democracy. 2/3rd recurring revenues with consistent 10% growth over the past 10 years. | Target Position (over 3 Qtrs) – 2% |

| Purchases | Recruit

|

Recruit is the parent company of Indeed and Glassdoor and provides human resource technology, marketing media, and temporary staffing services in Japan (47% revenues) and abroad. The business model aims to enable a level playing field for applicants and small businesses. The company is known for its progressive work culture including gender diversity across all levels of management, strong growth profile, balance sheet, and returns. | Target Position (over 3 Qtrs) – 2% |

| Purchases | California Water Service

|

California Water Service is the largest regulated water utility west of the Mississippi River and third largest in the country. Cal Water is the parent of seven water utility companies in California, New Mexico, Texas, Hawaii, and Washington and provides service to two million people. We plan to use partial proceeds from AWK to maintain our water utility exposure.

|

Partial Proceeds from AWK Sale – Maintain water utility exposure |

In a supplement to this letter, we are also presenting our investment thesis on Alphabet (Google), considering the recent Department of Justice ruling that found Google had illegally monopolized the search market. These events underscore the significance of our long-standing shareholder proposal advocating for enhanced corporate governance through the dismantling of the company’s dual-class voting structure.

Outside Investments [10]

As we enter the new year, our Outside Investments team has two initiatives that we hope will interest you:

Research

Our Outside Investments research function will now be part of our overall investment research team, thereby enhancing cross-fertilization of ideas and coordination of client priorities. Working with our CIO Nimrit Kang, Leah Neff and Leslie Christian will be responsible for evaluating values alignment and conducting financial research. This organizational change is proceeding smoothly and with eagerness from all parties.

Scope and Prioritization of Outside Investments

We are also eager to take the time to evaluate the set of Outside Investments that we currently recommend to our clients whose situations are conducive to holding illiquid investments that meet our criteria.

Our intention is to evaluate the geographic distribution, core business activities and focus, and liquidity/risk characteristics of our current Outside Investments with an eye toward identifying areas for more or less concentration. A part of this evaluation is to seek input from you, our clients. We hope you will continue to share with us your interests and priorities.

In addition to the above, we are in touch with the CDFIs and other organizations with which we work to understand how they are dealing with the repercussions of the election. Not surprisingly, there remains a great deal of uncertainty related to the promises and threats made during and after the election. As we wrote in last quarter’s Outside Investments section, now more than ever these organizations need our support as they work to chip away at the inequities that seem even more monumental now.

Shareholder Activism Update

Looking ahead for 2025, we remain steadfast in our commitment to driving meaningful change through our shareholder engagement efforts. For this filing season, we have re-filed proposals on fair chance employment and equal shareholder voting rights. Furthermore, given our historical work in helping PepsiCo create the first human right to water policy for a multinational company, we are revisiting this critical issue due to the rise of AI and its substantial water demands. We have become increasingly concerned with the extensive water consumption that data centers utilize to support AI workloads, specifically water used for cooling. For example, Microsoft used approximately 700,000 liters of water to train GPT-3. By 2027, global AI demand could drive water withdrawals to 4.2-6.6 billion cubic meters annually, equivalent to California’s total annual water use. With 20% of U.S. data centers across the economy located in drought-prone areas, these operations exacerbate existing water stress areas. From an environmental justice perspective, the impact of data centers on the local water supply is deeply troubling to us. With AI demand only growing, we have filed human right to water and water vulnerability risk assessment proposals at several tech companies with significant exposure to AI workloads. We have continued to collaborate with water experts including university professors, international water rights attorneys, scientists, and investigative journalists. Our engagements with these experts have been critical in informing our shareholder proposals related to datacenter water use as well as shaping our upcoming water paper.

As part of the proposal engagement process, we recently reached an agreement with Adobe for withdrawal as the company agreed to commit to engaging with its third-party data center providers regarding water conservation and water risk impacts to local surrounding communities. Engagements are underway for all other proposals; we will provide details in our next quarterly letter.

In terms of anti-ESG and DEI backlash, major brands and financial institutions have been retreating under pressure from right wing groups. Walmart recently “rolled back” its DEI commitments, ending racial equity training for staff, its supplier diversity program, and its participation in HRC’s annual benchmark index measuring workplace inclusion for LGBTQ+ employees as well as closing its Center for Racial Equity. American Airlines faces a legal battle that could set precedent for ESG related investments within retirement plans. A U.S. District Judge in Texas ruled that the airline company violated federal law by offering funds in its 401(k)-plan managed by companies that prioritize investment decisions using ESG factors over financial factors, which he argues violates ERISA. We are monitoring the developments in this case. BlackRock, the fund manager in question, also recently rolled back its climate commitments by exiting the Net Zero Asset Managers Initiative (NZAMI), joining a wave of major banks like JPMorgan Chase, Citi, and Goldman Sach. This led to the coalition suspending its activities.

Meanwhile, the shareholder proposal process is under threat from Project 2025 and the potential appointment of Paul Atkins as SEC Chair. Atkins, who had previously served as SEC commissioner between 2002-2008, has been outspokenly critical of the shareholder proposal process, particularly related to ESG issues. He has advocated for stricter proposal criteria (higher ownership thresholds, longer holding periods, refiling, etc.) and focusing only on those that are material to financial and operational performance. He believes the process to be a resource and cost burden for companies. He is yet to be confirmed by the Senate, but Atkins’ appointment could potentially impact the proposal process, causing progressive shareholders like NorthStar to pursue alternative engagement strategies.

Despite these attacks on our work and the issues we care about, there are rays of hope. While many companies have scaled back their DEI initiatives, portfolio companies like Costco and Apple are fighting against anti-DEI pressure. Both have urged shareholders to vote against proposals from the conservative National Center for Public Policy Research. These proposals seek a report on the financial risks to the respective companies of maintaining their DEI initiatives. Costco doubled down, emphasizing that its diversity has been a cornerstone of its long-term financial success and calling out NCPPR’s broader agenda as an “abolition of diversity initiatives” rather than risk reduction. While we are seeing rollbacks on progressive initiatives in the U.S., many of these brands still have global operations where they are required to report ESG related progress via programs such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and Corporate Sustainability Due Diligence Directive (CSDDD).

Amid all this, we are thrilled to report on the progress of Xylem’s fair chance employment program. Following our successful 2023 engagement, Xylem has expanded its program to four new cities: Buffalo, NY; Charlotte, NC; Colorado Springs, CO; and Pittsburgh, PA. The expansion is driven by a strategy to attract and retain reliable talent as well as supporting Xylem’s DEI goals. Notably, Xylem has launched a dedicated Fair Chance Employment page on its career website, signaling to the justice-involved community that they are welcome and valued at Xylem. We have also learned that other socially responsible colleagues have reached out to Xylem to understand how they can encourage their portfolio companies to adopt similar programs.

Administrative Matters

Let us know your thoughts and any questions you have about Orion

Over the past year we have been working on implementing Orion to replace Axys, the portfolio accounting system we have used since the mid-90s. With Orion, we can execute trades more efficiently through its Eclipse platform and utilize its robust portfolio accounting and reporting capabilities. We are very excited about Orion’s potential for helping us enhance the quality of our services to you.

As you navigate the client portal and review your quarterly statement, please let us know if you have any recommendations for improvement or have any questions. In the client portal, you will be able to:

- View Your Accounts: Easily check your account balances and monitor your portfolio information in real time.

- Access Important Documents and Reports: Securely view and download shared documents, such as statements, reports, and planning materials.

- Stay Informed: Receive timely updates and notifications about your investments, planning items, and any relevant changes.

Welcome our new joiners

We recently welcomed two new team members:

- Over the next few months, Corita Miles will be working with Client Services to integrate Salentica, our new CRM system, and Orion, our new portfolio accounting system, the day-to-day client operations. Corita has an extensive background in data and project management from her experience in biotech as a clinical researcher.

- Sam Freedman is in his final year at Northeastern University and will be with us as part of the university’s co-op program. He will focus on researching stocks in the tech industry. Sam is fluent in French and is majoring in International Affairs and Economics.

2024 tax packet preparation has begun

It’s that time of year again! Between late January and April 15th, we’re busy compiling and sending out your tax materials to you or your accountant. These materials come from your custodian, organizations holding your outside investments, charities you’vesupported, and our own records.

Our goal is to get everything to you or your accountant (at your direction) by the end of February (March 15th at the latest). However, since this process involves coordinating with several firms and organizations, our timeline depends on when we receive your 1099s, charitable gift acknowledgment letters, 1099-INTs, and other tax-related documents. Usually, we have these by mid-February, but sometimes there are delays.

If you have a meeting scheduled with your tax preparer, please email us at clientservices@northstarasset.com so we can prioritize sending your materials in advance of that meeting.

Sometimes, custodians issue corrected 1099s later. If this happens, don’t worry; we typically receive these by mid-March and will make sure you or your accountant gets the updated documents.

Thanks for your cooperation, and here’s to a smooth tax season ahead!

We are here to help and support you

We want to be sure you have all the support you need. If you have any questions or need assistance, please reach out to our dedicated Client Services Team. You can contact us via email at clientservices@northstarasset.com or give us a call at (617) 522-2635. We are here in the office daily, and, if you plan to visit us, please let us know in advance so we can ensure we’re prepared for your visit. Our commitment is to provide quick answers to your questions and handle your requests efficiently. Your satisfaction is our priority, so please don’t hesitate to reach out to us!

Sincerely,

Julie N.W. Goodridge Founder & Chief Executive Officer |

Nimrit Kang Chief Investment Officer |

Important Disclosures

Advisory services offered through NorthStar Asset Management, Inc., a registered investment adviser. Registration does not imply any level of skill or training. This communication is for educational purposes only. It is neither an offer to sell nor a solicitation of any offer to buy any securities, investment products, or investment advisory services.

This material may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual results will not be materially different from those described here.

Past performance is no guarantee of future results. All investment portfolios carry risk, including the risk of loss. No assurances can be given that NorthStar will attain its investment objective or that an investor will not lose invested capital.

This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation of or solicitation of any particular security, strategy, or investment product. The forecasts, opinions, and estimates expressed in this report constitute our judgment as of the date of this letter and are subject to change without notice based on market, economic, and other conditions. The assumptions used in our forecasts concern future events over which we have no control and may turn out to be materially different from actual experience.

NorthStar does not provide legal or tax advice, and nothing contained in these materials should be taken as legal or tax advice. Although NorthStar believes the data presented here to be reliable, we do not guarantee the accuracy of third-party data. Links to third party sites are provided for your convenience and do not constitute an endorsement. These sites may not have the same privacy, security or accessibility standards.

Indices are presented herein for illustrative and comparative purposes only. Such indices may not be available for direct investment, may be unmanaged, assume reinvestment of income, do not reflect the impact of any trading commissions and costs, management fees, or performance fees, and have limitations when used for comparison or other purposes because they, among other things, may have different strategies, volatility, credit, or other material characteristics. In considering performance results discussed here, prospective clients should note that equity portions of individually managed accounts may differ from the results shown here because of client-specific restrictions, client circumstances, client legacy positions, different fee and expense structures, actual trading, tax considerations, and other reasons.

[1] This report shows the quarterly change in your account value, your target asset allocation (equity, fixed income and cash), your current allocation, and your return (net of fees) for the last 10 years (or since you became a client) compared to your “custom benchmark,” which has the same percentages in each asset class as your account(s)’ current target allocation(s). If the total return of your account outperformed or underperformed your account’s custom benchmark, we will attempt to explain why in the body of this letter, and we are happy to review your individual situation with you. You also receive normal and customary trade confirmations and account statements from the custodian of your assets. If there is any discrepancy between the information included on the quarterly report provided by NorthStar and the information on your brokerage statement, the brokerage statement should be relied upon.

[2] https://gridstrategiesllc.com/wp-content/uploads/National-Load-Growth-Report-2024.pdf

[3] Source: UBS Global Wealth Databook 2024

[4] Source: Bloomberg; Unless otherwise noted, all data and numbers are sourced from Bloomberg

[5] Bloomberg

[6] Source: United Nations Department of Economic and Social Affairs, World Population Prospects 2022

[7] All data is for the quarter ending September 30, 2023, unless otherwise noted.

[8]All company specific commentary is based on the review of company SEC filings, company quarterly results and conference transcripts and our own analysis

[9] Net of fees calculation is based on deducting 1% management fee and custodian fees. You can see the management fee schedule and read more about how NorthStar calculates its fees in Form ADV Part 2A.

[10] Outside Investments are privately placed with various types of entities, as described above. Privately placed investments generally carry higher risk and are not publicly traded. In addition to the risks of equity, (which include, but are not limited to, changes in revenue, margins, earnings, dividends, cash flow, balance sheet, leverage, liquidity, solvency, legal matters, negative publicity, brand image, and general market volatility) and the risks of fixed income investing (such as credit risk, interest rate changes and the yield curve, inflation, default, monetary policy changes, government instability, and other risks), Outside Investments are typically illiquid and may not be sold easily. More information on the risks of Outside Investments may be found in the applicable product offering materials or in our ADV 2A brochure, located at: https://northstarasset.com/wp-content/uploads/2023/08/2025.0728-NSAM-ADV-Brochure-part-2A-final.pdf.

CONTACT US

- 617.522.2635

- 617.522.3165

- 2 Harris Ave, Boston, MA 02130View Location On Map

- P.O. Box 301840, Boston MA 02130