October 25, 2024Third Quarter 2024

Dear Client,

The third quarter of 2024 has ended and enclosed you will find your personalized quarterly performance report as of September 30th [1]. This letter will provide an explanation of overall NorthStar portfolio performance relative to our benchmarks. We are happy to review your individual account upon request. If your investment objectives, risk tolerance, or overall financial situation has changed, please contact us immediately.

Our View

Earlier this month Barack Obama spoke at a rally for Harris in Pittsburgh. What stood out to us was his direct criticism of Trump’s claims that he had created a great economy. It was the first time this falsehood by the Trump campaign has been highlighted so directly. The Harris campaign has tended to react to Trump’s protectionist, self-serving, and costly policy proposals rather than getting specific about the Biden/Harris long view and hammering home jobs gained and the inflationary impact of expanding tariffs. We think it would be helpful to explain how recovering from covid, tariffs, and supply chain issues fueled the inflationary environment that we have been experiencing. The migration from cities, along with the subsequent desire of many baby boomer homeowners to downsize, enhanced an already competitive and inflated real estate market and created chaos in urban environments. Falling revenue in cities from commercial real estate has yet to be fully realized, and we believe this will continue to put pressure on state economies to fund public transportation and infrastructure. This is the economic environment Biden/Harris inherited from Trump. It has been understood and addressed by the current administration, and there is an openness as well as an obvious need to do much more, both in terms of accomplishments and proposed plans.

One of the biggest challenges for any kind of fact-based, seemingly logical rebuttal to Trump’s claims is the absence of consensus on what is factual and what is not. It feels unreal to us that Trump’s support level can remain so strong. A recent podcast featured a psychologist that specializes in working with cult survivors. He described Trump followers as victims of a cult. On the other hand, friends who have trained to canvass for Harris report that the theme has been listening to where voters are at, with the presumed goal of putting an end to the “us against them” rhetoric by demonstrating openness. While this is a reasonable approach, it may be time to go for the jugular. We think it’s time for all the campaign surrogates to come out swinging with real substance and to talk concretely about why “WE ARE NOT GOING BACK!”

Having attended the DNC in August, I (Julie) was face to face with so many committed volunteers who have struggled as we all have with the disintegration of thoughtful discourse. Agreeing to disagree, the sense of a common humanity, highlighting ways that we are all united in our desires for a voice and maybe even a seat at the table, to care for one another, to do no harm, and to embrace our differences felt like a rallying cry. The big missing piece was a clear perspective on conflict in Israel. These attacks are so wildly painful, so gigantic, so horrific, and so wildly complicated. Our hearts are broken all around and we want this violence to STOP.

One last note. The calls are beginning to come in about which country to move to, how to protect one’s money, and the benefits of a Swiss bank account. We want to remind you that you, as holders of wealth, are likely the least likely people to be harmed in either upcoming administration. You have the resources to protect yourselves, and the investments that we make on your behalf are designed to provide you with sufficient resources to withstand short term volatility. Individuals and progressive organizations and foundations, like the ones for whom we manage endowments, need to stay laser focused on doing and funding good work to uplift those who will not be as fortunate if the tides turn again. Marginalized communities of people can’t move to Portugal or Canada. Obama said, “Don’t boo. Vote” and we say, “Don’t move. Vote, pay taxes, and contribute to the causes you believe in most.”

Update on Economic Outlook and NorthStar’s Strategy

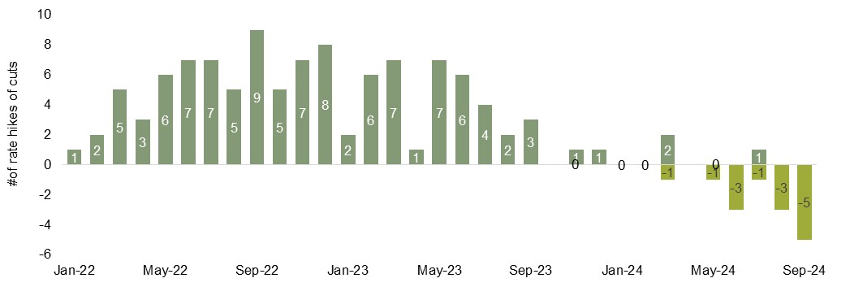

Q3, 2024: Monetary policy turns accommodative

On September 18, the Federal Reserve Board (Fed) lowered the target range for the federal funds rate by 0.50 percentage point to 4.75%-5.00%. This was the first reduction of the interest rate since March 2020, when the Fed made emergency rate cuts in response to the COVID-19 pandemic. The size of the cut was surprising to us–larger than expected, given the economy’s overall resilience with Q3 GDP at 3.2% [2]. Inflation appeared to be on a downward trend, with August’s core personal consumption expenditure rising at an annualized rate of 2.7% [3].

While lower interest costs may offer some relief to the lower-income and younger consumers facing higher credit costs, recovering from the rapid rise in rates in 2022 most immediately helps financial markets profit rather than translating into directly impacting the root causes of economic inequality. The costs of housing, food, childcare, and fuel remain extremely problematic. Tackling economic inequality requires compassionate, egalitarian, humble leadership and a government with the economic knowledge and motivation to care for all.

On the other side of the pond, stagnant economic demand led the European Central Bank to deliver a second .25% cut in September [4]. Japan, however, has seen improvements in domestic consumption, corporate profits and fixed investment. As a result, the Bank of Japan raised rates twice in 2024 but kept the policy rate steady at 0.25% in its recent September meeting [5].

Chart 1: Developed Market Central Banks: Hikers vs. Cutters

Source: various National Central Banks. The Conference Board as of 20 September 2024.

Source: various National Central Banks. The Conference Board as of 20 September 2024.

Developed Markets: US, Euro Area, UK, Canada, Australia, New Zealand, Sweden, Switzerland, Norway, Korea, Japan, Taiwan.

2024 Elections and potential implications

History suggests that equity and bond markets are primarily driven by economic and inflation trends, though there can be short term volatility leading up to the elections. Since 1928, the S&P 500 has posted average returns of 7.5% in election years vs. 8% in non-election years [6]. Markets generally favor divided governments, as this often preserves the status quo and requires legislative support for significant policy changes. Trump’s litany of his proposed executive actions is primarily focused on de-regulation, across the board tariffs, restrictive immigration policies, and politicization of civil services. Harris’ agenda emphasizes wealth redistribution by reversing Trump-era tax cuts, capping out-of-pocket costs for prescription drugs, and imposing tariffs only on select sectors [7]. Both plans would increase the national debt burden but only one aims to invest in the people, planet, and society.

As we learned in 2016, relying on popular polls to predict election outcomes can be risky, and this election cycle is no different, with poll results shifting almost daily. However, we do know that it is a close and a highly consequential election. According to OpenSecrets, a nonpartisan organization that tracks money in politics, the 2024 presidential and congressional elections are on track to be the most expensive federal elections in U.S. history, with spending expected to reach $15.9 billion.

As we have often noted, our approach to navigating these treacherous moments is to ensure that we understand your financial needs and objectives and establish an appropriate target asset allocation and liquid reserves. Secondly, we remain disciplined and committed to strategic asset allocation, maintaining appropriate diversification, and managing risk.

Selectivity in adding Fixed Income Exposure

We believe there is a high probability that interest rates will remain at these or higher levels over the mid-to-long term, as our government and others will need to fund Social Security, Medicare, and Defense programs while grappling with challenges related to ecological limits and socio-political upheaval. However, since the beginning of the year, yields on 10-year bonds have see-sawed from a low of 3.6% to a high of 4.7% in response [8] to every economic and inflation data point. We have stayed disciplined by buying bonds only when we believe yields reach attractive levels.

Where appropriate, we will continue to diversify across duration and add government bonds in the one to ten-year maturity range to our clients’ portfolios. We believe that bonds in this maturity range offer an optimal combination of flexibility, higher income returns, and stability for the portfolio.

High quality stocks with low debt can still provide long-term growth

Over the mid-to-long term, companies with low financial debt and that make products or sell services that we believe are beneficial to human life and that solve or mitigate some of the most pervasive problems of our time should continue to thrive, in our opinion. We focus our research on companies providing solutions and products to cope with:

- Ecological Limits: Our planet’s resources are increasingly under threat from ecological imbalances and decades of extractive growth.

- Aging and changing demographics: The world’s population aged 60 and over is growing faster than all younger groups and is expected to reach 1.4 billion by 2030, up from 1 billion in 2020 [9].

- Leveling the playing field: Digital transformation and new business models are enabling small businesses and entrepreneurs to compete with big business.

We aim to own and add stocks that offer competitive returns and diversification while also providing opportunities to create the greatest impact by changing corporate behavior via our shareholder activism work.

As a refresher, our investment strategy for the global equity portfolio involves significant independent research into each company’s growth prospects and financials combined with diligently examining the ethics of management and company behavior. The resulting portfolio, we believe, is more resilient, sustainable, and stable because of our broad-based focus. In addition, we follow our systematic quarterly rebalancing strategy in which we trim individual stocks that are well past their target weights and reallocate to stocks that are under their target levels. Of course, past performance is not an indicator of future performance, and all investing involves risk!

Third Quarter 2024 Performance [10]

Bond and equity markets post positive returns

The bond markets recorded the highest total returns of the year as the Fed reduced the Feds Fund Rate by 50 basis points. NorthStar’s fixed-income portfolios underperformed the intermediate-duration fixed-income benchmark due to a specific mix of treasuries, agency and green bonds, and CDFI notes.

The equity portions of NorthStar clients’ portfolios outperformed the MSCI All Country World Index, which posted a 6.4% return in the second quarter. Interest rate sensitive sectors such as Real Estate, Utilities and Financials led the returns for the quarter, while Technology and Energy posted negative returns. The NorthStar portfolio benefitted from the broader participation across sectors and stocks. Our holdings in the Consumer Staples, Materials and Energy sectors outperformed their respective benchmarks. From a regional perspective, our holdings in North America and Western Europe outperformed while relative performance lagged in Japan. It is worth noting that we do not own or plan to own any stocks in China due to concerns related to our five pillars. That may serve as a temporary headwind if the Chinese market outperforms significantly as it did this quarter with a 32% return.

NorthStar Global Equity Portfolio Stock Commentary

| 06/30/2024-09/30/2024 | |||

| Top Performers | Bottom Performers | ||

| Company | Total Return (IRR) | Company | Total Return (IRR) |

| PayPal Holdings | 34.5 | Novo Nordisk ADR | (16.3) |

| Straumann Holdings AG | 32.4 | Alphabet Inc Cl A | (8.9) |

| Sprouts Farmers Market Inc. | 32.0 | FedEx Corp | (8.3) |

| Adyen NV | 31.2 | Adobe Systems, Inc. | (6.8) |

| Tomra Systems | 23.8 | Intuit Inc | (5.4) |

Source: Axys/Advent

Note: IRR calculation is net of fees [11].

PayPal stock finally broke out of its cycle of underperformance after reporting an 8% year over year increase in revenues and 11% growth in total payment volume (TPV). The growth in TPV was driven primarily by Braintree (~+19%), branded checkout (+6%), and Venmo (+8%). The fiscal year guidance for earnings per share, free cash flow and share buyback was raised.

Novo Nordisk shares have underperformed as the company reported 25% growth in revenues but only 3% growth in earnings per share for the quarter, well below market expectations. The miss was due to supply constraints for Wegovy prescriptions. North America sales grew by 36% and international sales by11%. By therapy area, GLP-1 diabetes grew 32%, insulin by 10%, and obesity care by 37% while rare disease declined by 3%. Within diabetes care, the market share increased to 34.1%. Fiscal year guidance for revenue and earnings per share was raised modestly. The stock along with peers has also come under pressure due to higher scrutiny by legislators into the high cost of obesity drugs.

Alphabet reported an in-line to slightly below quarter with continued growth and profitability from the Cloud segment and a slight sequential slowdown in advertising sales due to a decline in network sales and price increases. Investors were also disappointed that there were no updates on the Search Generative Experience (SGE). Recently, DOJ won its legal case that Google illegally monopolized the search market. This can be a short-term net negative for Apple and Google. Long term, we believe that Alphabet’s various businesses such as YouTube, Android Operating System, Cloud, Subscriptions, Search, and Artificial Intelligence are worth significantly more as stand-alone entities, which bodes well for investors.

Outside Investments [12]

As the world swirls with uncertainty, fear, anxiety, and animosity, it’s tempting to react with spurts of frenetic activity and urgency—like the hare in the famous fable racing to catch up after snoozing confidently. Sometimes we forget that the tortoise won the race with a slow, steady approach. Without pushing the analogy too far, in times like these, it’s informative and maybe even comforting to acknowledge the efforts and accomplishment of our Outside Investments “hares” and to appreciate the characteristics that have led to their successes.

Many of the CDFIs (Community Development Financial Institutions) we support were founded decades ago and have been slowly and steadily addressing issues of inequity and injustice over the years. We’ve seen them evolve to meet the challenges of our times, building upon their foundations in the social justice and environmental movements that motivated many of them. For example, Cooperative Fund of the Northeast was founded in 1975 as Cooperative Fund of New England to support cooperative businesses and organizations—food co-ops, worker co-ops, housing co-ops, land trusts, and others. When COVID devastated many communities, CFNE created an emergency loan fund for struggling businesses, and, after George Floyd’s murder, CFNE built specific commitments and goals related to racial justice into their planning and operations.

There are countless organizations that have been working locally to address a housing crisis that has been decades in the making. For example, the Women’s Community Revitalization Project of Philadelphia, founded in 1986, develops and manages affordable housing for very low-income women and their families. They are activists and advocates who have been local leaders in collaboration and creativity, including partnering with the Community Justice Land Trust created in 2010 to make home ownership affordable.

Regenerative agriculture and sustainable forestry are gaining traction today thanks in large part to the foundational work of Ecotrust Forests (now EFMI) founded in 2003, Iroquois Valley Farms founded in 2007, and Dirt Capital Partners founded in 2014. Each of these organizations has worked and evolved to protect and sustain forests and non-industrial (commoditized) farms and farmers using the array of tools available to them and developing high levels of expertise to access opportunities ranging from government grants and support programs to carbon credits and value-added strategies for those most vulnerable (both ecologically and economically).

We appreciate the characteristics, associated skills, and wisdom of “tortoises.” Slow and steady means that the tortoise has on the ground perspective, the chance to consider and evaluate optimal ways forward, and wisdom derived from patience and inclusivity. The “tortoises” we respect are purposeful, dedicated, and effective—a balance that is critical today.

Shareholder Activism Update

Later this fall, we will refile several shareholder proposals and continue open engagements with several of the companies held in your portfolio. In preparation, the team has been engaging in knowledge sessions to deepen our understanding of issues related to systemic oppression, corporate over-reach, and the Human Right to Water.

Our work on Fair Chance hiring and prison labor continues to generate interest among prison rights advocates, which is exciting to us. We have been asked to work with an organization in Minnesota in their effort to enact legislation denouncing prison labor as slave labor and instead viewing all labor as worthy of state employment protections. We are beginning to discuss strategies to aid in getting corporate support for the legislation supporting broad worker protection.

As we have written about in past letters, shareholder activism and engagement have been under assault for the last few years. These assaults typically come from organizations like the Business Roundtable and conservative “think tanks” and we are members of a coalition to address these attacks as they arise in boardrooms, regulation, and legislation. Recently there was an Op-Ed by Rob Henderson attacking “activism” in a different way that caused us to take notice. Our team collaborated on a response to his piece in the New York Times in which he claimed that progressive activism is an elitist luxury. We responded to the NYT Opinion piece with a letter to the editor posted on our website. We highlighted how Henderson’s perspective misrepresents those working toward systemic change. By focusing on selective protests and ignoring important data, his arguments overlook the real-life experiences of marginalized communities. We believe strongly that all of us must use the tools that we have access to create beneficial change for all.

In collaboration with Ekō and the Tech Justice Law Project, we submitted a amicus brief to the U.S.Supreme Court asking them to recognize the critical importance of data-security risks that led to the Cambridge Analytica data breach scandal. In every year since 2014, NorthStar has filed shareholder proposals, supported by a substantial portion of Facebook (now Meta) shareholders, requesting that the Board implement changes to the Company’s voting structure so each share of Facebook common stock would entitle its holder to one vote and removing the super-voting shares. We are proud to have contributed to this amicus brief in defense of shareholder rights.

Administrative Matters

We want to make sure you have all the support you need. If you have any questions or need assistance, please reach out to our dedicated Client Services Team. You can contact us via email at clientservices@northstarasset.com or give us a call at (617) 522-2635. We are here in the office daily, and, if you plan to visit us, please let us know in advance so we can ensure we’re prepared for your visit. Our commitment is to provide quick answers to your questions and handle your requests efficiently. Your satisfaction is our priority, so please don’t hesitate to reach out to us!

Office Closures

A friendly reminder: the NorthStar office will be closed on the following dates:

- Thanksgiving Break: Wednesday, November 27th, at 1 PM through Friday, November 29th. We will reopen on Monday, December 2nd, at 8:30 AM EST.

- Annual End-of-Year Office Closure: Tuesday, December 24th, at 1 PM through Wednesday, January 1st. We will reopen on Thursday, January 2nd, at 8:30 AM EST.

For urgent requests during this time, please contact your custodian directly:

Custodian Information:

- Stephen Calderara at Morgan Stanley: (978) 739-9652

- Schwab Alliance Team: (800) 515-2157

If your request is not urgent, please feel free to send us an email at clientservices@northstarasset.com or leave us a message at (617) 522-2635.

Please note that the stock market and many financial firms will be closed on the following dates:

- Thursday, November 28th

- Wednesday, December 25th

- Wednesday, January 1st

Charitable Giving

As year-end approaches, we’d like to remind you to complete your charitable giving for 2024. If we’ve helped you with donations before, keep an eye on your email for a gift form (if applicable), a record of your 2023 donations, and a summary of this year’s donations (if applicable).

If you plan to give $1,000 or more to your favorite nonprofit(s) or need assistance with opening and contributing to a donor-advised fund for the first time, please reach out to us via phone or email—we’re here to help! For donations under $1,000, we can help with a funds transfer to your checking account so you can write checks directly to the organizations you support.

Sincerely,

Julie N.W. Goodridge Founder & Chief Executive Officer |

Nimrit Kang Chief Investment Officer |

[1] This report shows the quarterly change in your account value, your target asset allocation (equity, fixed income and cash), your current allocation, and your return (net of fees) for the last 10 years (or since you became a client) compared to your “custom benchmark,” which has the same percentages in each asset class as your account(s)’ current target allocation(s). If the total return of your account outperformed or underperformed your account’s custom benchmark, we will attempt to explain why in the body of this letter, and we are happy to review your individual situation with you. You also receive normal and customary trade confirmations and account statements from the custodian of your assets. If there is any discrepancy between the information included on the quarterly report provided by NorthStar and the information on your brokerage statement, the brokerage statement should be relied upon.

[2] October 9, 2024: https://www.atlantafed.org/cqer/research/gdpnow

[3] Bloomberg, Federal Reserve Bank of St. Louis Economic Data

[4] https://www.ecb.europa.eu/

[5] https://www.boj.or.jp/en/mopo/mpmsche_minu/index.htm

[6] https://privatebank.jpmorgan.com/nam/en/insights/markets-and-investing/ideas-and-insights/election-year-investing-jitters-considerations-that-could-set-you-at-ease

[7] https://res.americancentury.com/docs/2024-presidential-election-policy-comparison-table.pdf

[8] Bloomberg

[9] Source: United Nations Department of Economic and Social Affairs, World Population Prospects 2022

[10] All data is for the quarter ending September 30, 2023, unless otherwise noted.

[11] Net of fees calculation is based on deducting 1% management fee and custodian fees. You can see the management fee schedule and read more about how NorthStar calculates its fees in Form ADV Part 2A.

[12] Outside Investments are privately placed with various types of entities, as described above. Privately placed investments generally carry higher risk and are not publicly traded. In addition to the risks of equity, (which include, but are not limited to, changes in revenue, margins, earnings, dividends, cash flow, balance sheet, leverage, liquidity, solvency, legal matters, negative publicity, brand image, and general market volatility) and the risks of fixed income investing (such as credit risk, interest rate changes and the yield curve, inflation, default, monetary policy changes, government instability, and other risks), Outside Investments are typically illiquid and may not be sold easily. More information on the risks of Outside Investments may be found in the applicable product offering materials or in our ADV 2A brochure, located at: https://northstarasset.com/wp-content/uploads/2023/08/Northstar-Asset-Management-Part-2A-2.22.2025.pdf.

Important Disclosures

Advisory services offered through NorthStar Asset Management, Inc., a registered investment adviser. Registration does not imply any level of skill or training. This communication is for educational purposes only. It is neither an offer to sell nor a solicitation of any offer to buy any securities, investment products, or investment advisory services.

This material may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual results will not be materially different from those described here.

Past performance is no guarantee of future results. All investment portfolios carry risk, including the risk of loss. No assurances can be given that NorthStar will attain its investment objective or that an investor will not lose invested capital.

This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation of or solicitation of any particular security, strategy, or investment product. The forecasts, opinions, and estimates expressed in this report constitute our judgment as of the date of this letter and are subject to change without notice based on market, economic, and other conditions. The assumptions used in our forecasts concern future events over which we have no control and may turn out to be materially different from actual experience.

NorthStar does not provide legal or tax advice, and nothing contained in these materials should be taken as legal or tax advice. Although NorthStar believes the data presented here to be reliable, we do not guarantee the accuracy of third-party data. Links to third party sites are provided for your convenience and do not constitute an endorsement. These sites may not have the same privacy, security or accessibility standards.

Indices are presented herein for illustrative and comparative purposes only. Such indices may not be available for direct investment, may be unmanaged, assume reinvestment of income, do not reflect the impact of any trading commissions and costs, management fees, or performance fees, and have limitations when used for comparison or other purposes because they, among other things, may have different strategies, volatility, credit, or other material characteristics. In considering performance results discussed here, prospective clients should note that equity portions of individually managed accounts may differ from the results shown here because of client-specific restrictions, client circumstances, client legacy positions, different fee and expense structures, actual trading, tax considerations, and other reasons.

CONTACT US

- 617.522.2635

- 617.522.3165

- 2 Harris Ave, Boston, MA 02130View Location On Map

- P.O. Box 301840, Boston MA 02130