[vc_row][vc_column][rev_slider_vc alias=”what-we-do6″][/vc_column][/vc_row][vc_row full_width=”stretch_row” el_id=”stripe”][vc_column][vc_raw_html]JTNDZGl2JTIwY2xhc3MlM0QlMjJsaW5rcyUyMiUzRSUwQSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIybDElMjIlM0UlMEElMDklMDklM0NhJTIwaHJlZiUzRCUyMmh0dHBzJTNBJTJGJTJGbm9ydGhzdGFyYXNzZXQuY29tJTJGJTIyJTNFSG9tZSUzQyUyRmElM0UlMEElMDklM0MlMkZkaXYlM0UlMEElMDklM0NkaXYlMjBjbGFzcyUzRCUyMmwyJTIyJTNFJTBBJTA5JTA5JTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRm5vcnRoc3RhcmFzc2V0LmNvbSUyRndoYXQtd2UtZG8lMjIlM0VXaGF0JTIwV2UlMjBEbyUzQyUyRmElM0UlMEElMDklM0MlMkZkaXYlM0UlMEElMDklM0NkaXYlMjBjbGFzcyUzRCUyMmwzJTIyJTNFJTBBJTA5JTA5JTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRm5vcnRoc3RhcmFzc2V0LmNvbSUyRmNyZWF0aW5nLWNoYW5nZSUyMiUzRUNyZWF0aW5nJTIwQ2hhbmdlJTNDJTJGYSUzRSUwQSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIybDQlMjIlM0UlMEElMDklMDklM0NhJTIwaHJlZiUzRCUyMmh0dHBzJTNBJTJGJTJGbm9ydGhzdGFyYXNzZXQuY29tJTJGbmV3cyUyMiUzRU5ld3MlMjAlMkIlMjBWaWV3cyUzQyUyRmElM0UlMEElMDklM0MlMkZkaXYlM0UlMEElMDklM0NkaXYlMjBjbGFzcyUzRCUyMmw1JTIyJTNFJTBBJTA5JTA5JTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRm5vcnRoc3RhcmFzc2V0LmNvbSUyRmFib3V0JTIyJTNFQWJvdXQlMjBVcyUzQyUyRmElM0UlMEElMDklM0MlMkZkaXYlM0UlMEElM0MlMkZkaXYlM0U=[/vc_raw_html][/vc_column][/vc_row][vc_row css=”.vc_custom_1450368269389{padding-top: 90px !important;padding-bottom: 90px !important;}” el_id=”welcome”][vc_column width=”1/4″ css=”.vc_custom_1450903307406{margin-bottom: 25px !important;}”][vc_widget_sidebar sidebar_id=”what-we-do”][/vc_column][vc_column width=”3/4″ css=”.vc_custom_1729118664193{margin-top: 30px !important;}”][vc_column_text css=””]

NorthStar Global Equity Portfolio (Institutional)

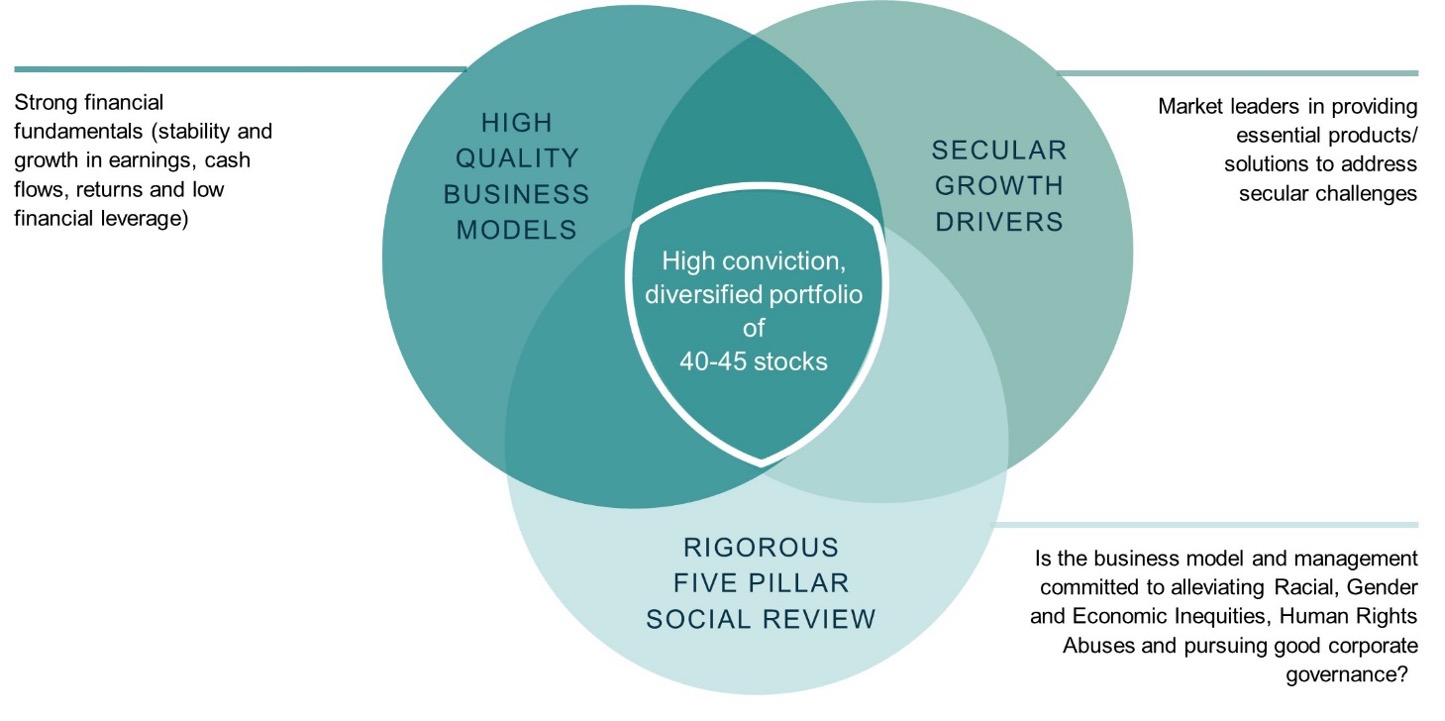

Investment Philosophy

We seek to deliver social and financial returns for our clients:

Markets consistently underestimate the persistency of high returns (CFROI) for businesses with resilient moats, sustainable long term growth characteristics, track record of strong management execution and disciplined capital allocation

Superior excess returns can be realized over medium to long-term by:

- Investing in these quality franchises at an attractive valuation

- Allowing the value to compound over the medium to long term investment horizon

We believe that no publicly traded company is socially responsible, but we seek to drive positive social returns and contributions to our planet and society by:

- Engaging with portfolio companies on our five pillars to advocate for positive change

- Employing creative progressive shareholder proposals and advocacy to urge investee companies to improve their corporate behavior

Pathways for Social Change:

- Avoiding business models that cause harm, exploit vulnerable populations, or perpetuate systemic inequities

- Strategically selecting companies with products and services addressing the most pressing problems of our times

- Active engagement and employment of progressive shareholder proposals centered on our five pillars urging investee companies to improve their corporate behavior

Portfolio Oriented Towards Long Term Secular Trends

Global Equity Portfolio Investment Process

We are long-term investors with low portfolio turnover (20-25%)

Top Five Holdings (1)

(as of 6/30/2024)

| COMPANY | WEIGHT % |

| Apple | 4.6% |

| Linde | 4.4% |

| Microsoft | 4.3% |

| Stryker Corp. | 4.2% |

| Unilever | 4.0% |

| Total | 21.5% |

NorthStar Global Equity Portfolio ESG Metrics – September 30, 2024 (2)

| FACTORS | METRICS | NorthStar Global Equity | ISHARES CORE S&P 1500 ETF (SPTM) | ISHARES MSCI ACWI

(ACWI) |

||

| Equity Holdings | 40 | 1522 | 2401 | |||

| ENVIRONMENTAL | Energy Intensity per Sales

(MWh/1m USD sales) (3) |

326 | 394 | 464 | ||

| Greenhouse (Scope 1 & 2) Gas Intensity per Sales (mt/1m USD sales) (3) | 84 | 96 | 134 | |||

| Greenhouse (Scope 1, 2 & 3) Gas Intensity per Sales (mt/1m USD sales) (3) | 630 | 831 | 928 | |||

| Water Intensity per Sales (3)* | 16K | 15K | 15K | |||

| (cbm/1m USD sales) | ||||||

| SOCIAL & GOVERNANCE | Bloomberg Governance Pillar Percentile(%) | 86% | 86% | 79% | ||

| % Women Directors on Board | 35% | 33% | 32% | |||

| % Independent Board Directors | 80% | 85% | 78% |

NorthStar Global Equity Portfolio Characteristics – December 31, 2024 (4)

| CHARACTERITICS (AS OF 12/31/2024) | PORTFOLIO | BENCHMARK (5) |

| Equity Holdings | 42 | 2293 |

| 3-yr Annualized Turnover % | 24.1 | — |

| Dividend Yield % | 1.31 | 2.00 |

| Price to Cash Flow Ratio | 21.87 | 15.72 |

| Price to Book Ratio | 5.89 | 3.13 |

| Weighted Avg. Mkt. Cap. | $550b | $751b |

| 2-yr Beta | 0.95 | 1.00 |

| P/E Ratio (Next 12 mo.) | 25.13 | 17.91 |

| Return on Equity (5 year avg.) | 32.97 | 30.03 |

| Net Debt/Equity % | 80.38 | 47.80 |

| Net Debt/EBITDA (Last 12 mo.) | 0.67 | 0.53 |

| Active Share % | 86 | — |

| Jan 2013-Dec 2024 | Portfolio |

| Annualized Standard Deviation % | 8.39% |

| Tracking Error % | 5.03% |

| Downside Capture Ratio % | 91% |

| Upside Capture Ratio % | 107% |

| Information Ratio | 0.64 |

| Sharpe Ratio | 1.20 |

NorthStar Global Equity Portfolio Weights and Historical Ranges (as of September 30, 2024)

| 2Q, 2024 SECTORS | PORTFOLIO | BENCHMARK (5) |

| Communication Services | 4.5% | 7.7% |

| Consumer Discretionary | 15.6% | 14.7% |

| Consumer Staples | 9.7% | 6.4% |

| Financial | 9.5% | 16.2% |

| Healthcare | 15.6% | 11.0% |

| Industrials | 17.2% | 10.3% |

| Materials | 7.7% | 4.0% |

| Technology | 10.5% | 20.4% |

| Utilities | 2.2% | 2.6% |

| Energy | 5.4% | 4.5% |

| Real Estate | 2.2% | 2.2% |

| REGION | PORTFOLIO | BENCHMARK (5) |

| North America | 75.5% | 66.1% |

| Western Europe | 23.5% | 16.0% |

| Asia Pacific | 1.2% | 14.0% |

| South & Central America | 0.0% | 0.7% |

| Africa/Middle East/Other | 0.0% | 3.6% |

| MARKET CAPITALIZATION | PORTFOLIO | BENCHMARK (5) |

| Small | 8.2% | 4.2% |

| Mid | 14.1% | 14.6% |

| Large | 77.7% | 80.9% |

[/vc_column_text][vc_column_text css=””]

Portfolio Team

50+ Years of Combined Portfolio Management Experience

[/vc_column_text][cms_grid col_xs=”2″ col_sm=”2″ col_md=”3″ col_lg=”3″ source=”size:2|order_by:menu_order|post_type:attorneys|by_id:3890,1627″ cms_template=”cms_grid–layout-attorneys1.php”][vc_column_text css=””][1] Historical performance indications and financial market scenarios are not reliable indicators of current or future performance. Past performance is not a guarantee of future results. This report is provided for illustrative purposes only and is neither a guarantee nor a prediction of future performance. This should not be considered a recommendation or solicitation to purchase securities. Holdings are subject to change. Holdings and weightings are based on a representative portfolio. Individual Investors’ holdings may differ slightly. Data is obtained by Bloomberg and is assumed to be reliable.

[2] Source: Bloomberg

[3] Due to lack of full data availability for each time period and significant lag on individual company basis, the aggregation methodology is weighted average and utilizes the last reported data for each company which may not aggregate to a single year or time period across the universe; Water Intensity Data is available for 50% of the benchmark constituents and 60% of portfolio holdings

[4] Source: Bloomberg and Axys/Advent

[5] Benchmark : iShares MSCI ACWI ETF. Sharpe Ratio is based on 3% average 3-month treasury note

Disclosures

Investment advisory services are offered through NorthStar Asset Management, Inc., an investment adviser registered with the U.S. Securities and Exchange Commission (“SEC” or “Commission”). Registration with the SEC does not constitute an endorsement of the firm by the Commission, nor does it indicate that the adviser has attained a particular level of skill or ability.. This communication is for educational purposes only. It is neither an offer to sell nor a solicitation of any offer to buy any securities, investment products, or investment advisory services.

This material may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual results will not be materially different from those described here.

The performance data quoted represents past performance. Past performance is no guarantee of future results. All investment portfolios carry risk, including the risk of loss. No assurances can be given that NorthStar will attain its investment objective or that an investor will not lose invested capital.

Composite Characteristics: The NorthStar Global Equity Composite is a collection of separate accounts managed by NorthStar Asset Management. Currently the composite holds approximately 65% equities, 27% fixed income and 8% cash and equivalents. The composite is tracked by Axys (an Advent company). The composite is $609 million dollars of total assets and made up of 372 accounts. (If applicable: These are actual clients of the firm and are all managed by the NorthStar portfolio management team). The strategy is global (US and abroad) equities, fixed income, and cash. The composite does not reinvest dividends. Individual account performance will differ. Past performance is not indicative of future results. The composite was created on 12/31/2012. The firm’s list of composite descriptions is available upon request.

Calculation Methodology: Composite returns are calculated by asset-weighting the individual portfolio returns using beginning-of-period values. Composite returns are calculated on a daily basis and geometrically linked to calculate the monthly return. Cash flow timing method: contributions are recorded at the beginning of the day (AM) and distributions are recorded at the end of the day (PM). We do not use leverage as part of investment strategy. Derivatives are not used. Our policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request.

Performance is calculated using Axys/Advent. YTD numbers are not annualized. Past performance is no guarantee of future results. Investment involves risk of loss.[/vc_column_text][/vc_column][/vc_row][vc_row full_width=”stretch_row” el_id=”contact” css=”.vc_custom_1450978764878{padding-top: 90px !important;padding-bottom: 90px !important;background-color: #585354 !important;}”][vc_column][vc_row_inner el_class=”inner” css=”.vc_custom_1450979398060{padding-top: 50px !important;padding-right: 50px !important;padding-bottom: 50px !important;padding-left: 50px !important;background-color: #ffffff !important;}”][vc_column_inner width=”1/2″][vc_custom_heading text=”CONTACT US” font_container=”tag:h2|font_size:35px|text_align:center|color:%23007678″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][vc_empty_space height=”60px”][vc_raw_html]JTNDZGl2JTIwc3R5bGUlM0QlMjJmb250LWZhbWlseSUzQVJvYm90byUzQmZvbnQtc2l6ZSUzQTE2cHglM0Jjb2xvciUzQSUyMzI4MjgyOCUzQiUyMG1hcmdpbi1sZWZ0JTNBMTVweCUzQiUyMiUzRSUwQSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIydmNfcm93JTIwd3BiX3JvdyUyMHZjX2lubmVyJTIwdmNfcm93LWZsdWlkJTIwY29sdW1uLWRlZmF1bHQlMjIlM0UlMEElMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMnZjX2NvbHVtbl93cmFwcGVyJTIwY2xlYXJmaXglMjIlM0UlMEElMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMnZjX2NvbC1zbS02JTIwd3BiX2NvbHVtbiUyMHZjX2NvbHVtbl9jb250YWluZXIlMjBsaXN0LW5vbmUlMjB0ZXh0LWFsaWduLW5vbmUlMjB0ZXh0LXJwLWxlZnQlMjAlMjIlM0UlMEElMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMndwYl93cmFwcGVyJTIyJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTNDZGl2JTIwY2xhc3MlM0QlMjJ3cGJfcmF3X2NvZGUlMjB3cGJfY29udGVudF9lbGVtZW50JTIwd3BiX3Jhd19odG1sJTIyJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTA5JTNDZGl2JTIwY2xhc3MlM0QlMjJ3cGJfd3JhcHBlciUyMiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ3NwYW4lMjBzdHlsZSUzRCUyMmNvbG9yJTNBJTIzODQ5OTc1JTNCJTIyJTIwY2xhc3MlM0QlMjJjb2xvci1wcmltYXJ5JTIwYmxvY2slMjIlM0VQSE9ORSUzQyUyRnNwYW4lM0UlMEElMDklMDklMDklMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMnBhZ2UtZ2V0LWNvbnRhY3QlMjIlM0UlMEElMDklMDklMDklMDklMDklMDklMDklMDklM0N1bCUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ2xpJTNFJTNDaSUyMGNsYXNzJTNEJTIyZmElMjBmYS1waG9uZSUyMiUzRSUzQyUyRmklM0U2MTcuNTIyLjI2MzUlM0MlMkZsaSUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ2xpJTNFJTNDaSUyMGNsYXNzJTNEJTIyZmElMjBmYS1mYXglMjIlM0UlM0MlMkZpJTNFNjE3LjUyMi4zMTY1JTNDJTJGbGklM0UlMEElMDklMDklMDklMDklMDklMDklMDklMDklM0MlMkZ1bCUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUyMCUwQSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUyMCUwQSUwOSUwOSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIydmNfY29sLXNtLTYlMjB3cGJfY29sdW1uJTIwdmNfY29sdW1uX2NvbnRhaW5lciUyMGxpc3Qtbm9uZSUyMHRleHQtYWxpZ24tbm9uZSUyMHRleHQtcnAtbGVmdCUyMCUyMiUzRSUwQSUwOSUwOSUwOSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIyd3BiX3dyYXBwZXIlMjIlM0UlMEElMDklMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMndwYl9yYXdfY29kZSUyMHdwYl9jb250ZW50X2VsZW1lbnQlMjB3cGJfcmF3X2h0bWwlMjIlM0UlMEElMDklMDklMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMndwYl93cmFwcGVyJTIyJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTA5JTA5JTNDc3BhbiUyMHN0eWxlJTNEJTIyY29sb3IlM0ElMjM4NDk5NzUlM0IlMjIlMjBjbGFzcyUzRCUyMmNvbG9yLXByaW1hcnklMjBibG9jayUyMiUzRUVNQUlMJTNDJTJGc3BhbiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIycGFnZS1nZXQtY29udGFjdCUyMiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ3VsJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTA5JTA5JTA5JTA5JTNDbGklM0UlM0NpJTIwY2xhc3MlM0QlMjJmYSUyMGZhLWVudmVsb3BlJTIyJTNFJTNDJTJGaSUzRSUzQ2ElMjBocmVmJTNEJTIybWFpbHRvJTNBaW5mbyU0MG5vcnRoc3RhcmFzc2V0LmNvbSUyMiUzRWluZm8lNDBub3J0aHN0YXJhc3NldC5jb20lM0MlMkZhJTNFJTNDJTJGbGklM0UlMEElMDklMDklMDklMDklMDklMDklMDklMDklM0MlMkZ1bCUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUzQ3NwYW4lMjBzdHlsZSUzRCUyMmNvbG9yJTNBJTIzODQ5OTc1JTNCJTIyJTIwY2xhc3MlM0QlMjJjb2xvci1wcmltYXJ5JTIwYmxvY2slMjIlM0VQUkVTUyUzQyUyRnNwYW4lM0UlMEElMDklMDklMDklMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMnBhZ2UtZ2V0LWNvbnRhY3QlMjIlM0UlMEElMDklMDklMDklMDklMDklMDklMDklMDklM0N1bCUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ2xpJTNFJTNDaSUyMGNsYXNzJTNEJTIyZmElMjBmYS1hdCUyMiUzRSUzQyUyRmklM0UlM0NhJTIwaHJlZiUzRCUyMm1haWx0byUzQXByZXNzJTQwbm9ydGhzdGFyYXNzZXQuY29tJTIyJTNFcHJlc3MlNDBub3J0aHN0YXJhc3NldC5jb20lM0MlMkZhJTNFJTNDJTJGbGklM0UlMEElMDklMDklMDklMDklMDklMDklMDklMDklM0MlMkZ1bCUzRSUwQSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUyMCUwQSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUyMCUwQSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIydmNfcm93JTIwd3BiX3JvdyUyMHZjX2lubmVyJTIwdmNfcm93LWZsdWlkJTIwY29sdW1uLWRlZmF1bHQlMjIlM0UlMEElMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMnZjX2NvbHVtbl93cmFwcGVyJTIwY2xlYXJmaXglMjIlM0UlMEElMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMnZjX2NvbC1zbS02JTIwd3BiX2NvbHVtbiUyMHZjX2NvbHVtbl9jb250YWluZXIlMjBsaXN0LW5vbmUlMjB0ZXh0LWFsaWduLW5vbmUlMjB0ZXh0LXJwLWxlZnQlMjAlMjIlM0UlMEElMEElMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMndwYl93cmFwcGVyJTIyJTNFJTBBJTBBJTA5JTA5JTA5JTA5JTA5JTNDZGl2JTIwY2xhc3MlM0QlMjJ3cGJfcmF3X2NvZGUlMjB3cGJfY29udGVudF9lbGVtZW50JTIwd3BiX3Jhd19odG1sJTIyJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTA5JTNDZGl2JTIwY2xhc3MlM0QlMjJ3cGJfd3JhcHBlciUyMiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ3NwYW4lMjBzdHlsZSUzRCUyMmNvbG9yJTNBJTIzODQ5OTc1JTNCJTIyJTIwY2xhc3MlM0QlMjJjb2xvci1wcmltYXJ5JTIwYmxvY2slMjIlM0VPRkZJQ0UlMjBBRERSRVNTJTNDJTJGc3BhbiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ2RpdiUyMGNsYXNzJTNEJTIycGFnZS1nZXQtY29udGFjdCUyMiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ3VsJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTA5JTA5JTA5JTA5JTNDbGklM0UlM0NpJTIwY2xhc3MlM0QlMjJmYSUyMGZhLW1hcC1tYXJrZXIlMjIlM0UlM0MlMkZpJTNFMiUyMEhhcnJpcyUyMEF2ZSUyQyUyMEJvc3RvbiUyQyUyME1BJTIwMDIxMzAlM0NhJTIwaHJlZiUzRCUyMmh0dHBzJTNBJTJGJTJGZ29vLmdsJTJGbWFwcyUyRlNqam83TlQ4Y1NLMiUyMiUzRVZpZXclMjBMb2NhdGlvbiUyME9uJTIwTWFwJTNDJTJGYSUzRSUzQyUyRmxpJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTA5JTA5JTA5JTNDJTJGdWwlM0UlMEElMDklMDklMDklMDklMDklMDklMDklM0MlMkZkaXYlM0UlMEElMDklMDklMDklMDklMDklMDklM0MlMkZkaXYlM0UlMEElMDklMDklMDklMDklMDklM0MlMkZkaXYlM0UlMEElMDklMDklMDklMDklM0MlMkZkaXYlM0UlMjAlMEElMDklMDklMDklM0MlMkZkaXYlM0UlMjAlMEElM0NkaXYlMjBjbGFzcyUzRCUyMnZjX2NvbC1zbS02JTIwd3BiX2NvbHVtbiUyMHZjX2NvbHVtbl9jb250YWluZXIlMjBsaXN0LW5vbmUlMjB0ZXh0LWFsaWduLW5vbmUlMjB0ZXh0LXJwLWxlZnQlMjAlMjIlM0UlMEElMEElMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMndwYl93cmFwcGVyJTIyJTNFJTBBJTBBJTA5JTA5JTA5JTA5JTA5JTNDZGl2JTIwY2xhc3MlM0QlMjJ3cGJfcmF3X2NvZGUlMjB3cGJfY29udGVudF9lbGVtZW50JTIwd3BiX3Jhd19odG1sJTIyJTNFJTBBJTA5JTA5JTA5JTA5JTA5JTA5JTNDZGl2JTIwY2xhc3MlM0QlMjJ3cGJfd3JhcHBlciUyMiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ3NwYW4lMjBzdHlsZSUzRCUyMmNvbG9yJTNBJTIzODQ5OTc1JTNCJTIyJTIwY2xhc3MlM0QlMjJjb2xvci1wcmltYXJ5JTIwYmxvY2slMjIlM0VNQUlMSU5HJTIwQUREUkVTUyUzQyUyRnNwYW4lM0UlMEElMDklMDklMDklMDklMDklMDklMDklM0NkaXYlMjBjbGFzcyUzRCUyMnBhZ2UtZ2V0LWNvbnRhY3QlMjIlM0UlMEElMDklMDklMDklMDklMDklMDklMDklMDklM0N1bCUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQ2xpJTNFJTNDaSUyMGNsYXNzJTNEJTIyZmElMjBmYS1tYXAtbWFya2VyJTIyJTNFJTNDJTJGaSUzRVAuTy4lMjBCb3glMjAzMDE4NDAlMkMlMjBCb3N0b24lMjBNQSUyMDAyMTMwJTNDJTJGbGklM0UlMEElMDklMDklMDklMDklMDklMDklMDklMDklM0MlMkZ1bCUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUyMCUwQSUwOSUwOSUwOSUzQyUyRmRpdiUzRSUyMCUwQSUwOSUwOSUzQyUyRmRpdiUzRSUwQSUwOSUzQyUyRmRpdiUzRSUwQSUzQyUyRmRpdiUzRQ==[/vc_raw_html][/vc_column_inner][vc_column_inner width=”1/2″][vc_custom_heading text=”AFFILIATIONS” font_container=”tag:h2|font_size:35px|text_align:center|color:%23007678″ google_fonts=”font_family:Raleway%3A100%2C200%2C300%2Cregular%2C500%2C600%2C700%2C800%2C900|font_style:700%20bold%20regular%3A700%3Anormal”][vc_raw_html el_class=”affiliations”]JTNDYSUyMGhyZWYlM0RodHRwcyUzQSUyRiUyRnd3dy5ncmVlbmFtZXJpY2Eub3JnJTJGZ3JlZW4tYW1lcmljYS1ncmVlbi1idXNpbmVzcy1jZXJ0aWZpY2F0aW9uJTIwdGFyZ2V0JTNEX2JsYW5rJTNFJTNDaW1nJTIwc3JjJTNEaHR0cHMlM0ElMkYlMkZub3J0aHN0YXJhc3NldC5jb20lMkZ3cC1jb250ZW50JTJGdXBsb2FkcyUyRjIwMTklMkYwNyUyRkdBU2VhbC0yMDE2LVdlYi0xNjB3LWVkaXQuanBnJTIwJTJGJTNFJTNDJTJGYSUzRSUwQSUzQ2ltZyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGbm9ydGhzdGFyYXNzZXQuY29tJTJGd3AtY29udGVudCUyRnVwbG9hZHMlMkYyMDIxJTJGMDQlMkYyMDE4LUItQ29ycC1Mb2dvLUJsYWNrLU0uanBnJTIyJTNFJTBBJTNDaW1nJTIwc3JjJTNEJTIyaHR0cHMlM0ElMkYlMkZub3J0aHN0YXJhc3NldC5jb20lMkZ3cC1jb250ZW50JTJGdXBsb2FkcyUyRjIwMjElMkYwNCUyRkpQLUJBUEEtbG9nby5wbmclMjIlM0UlMEElM0NpbWclMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRm5vcnRoc3RhcmFzc2V0LmNvbSUyRndwLWNvbnRlbnQlMkZ1cGxvYWRzJTJGMjAxOSUyRjA3JTJGV0JFX1NlYWxfUkdCLnBuZyUyMiUzRSUwQSUzQ2ltZyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGbm9ydGhzdGFyYXNzZXQuY29tJTJGd3AtY29udGVudCUyRnVwbG9hZHMlMkYyMDIxJTJGMDQlMkZUUENfTG9nb19MLnBuZyUyMiUzRSUwQSUzQ2ltZyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGbm9ydGhzdGFyYXNzZXQuY29tJTJGd3AtY29udGVudCUyRnVwbG9hZHMlMkYyMDE5JTJGMDclMkZQUkktU2lnLVdlYi1WMS5wbmclMjIlM0UlMEElM0NhJTIwaHJlZiUzRCUyMmh0dHBzJTNBJTJGJTJGd3d3LnVzc2lmLm9yZyUyRiUyMiUyMHRpdGxlJTNEJTIyVVMlMjBTSUYlMjIlM0UlM0NpbWclMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRm5vcnRoc3RhcmFzc2V0LmNvbSUyRndwLWNvbnRlbnQlMkZ1cGxvYWRzJTJGMjAyMiUyRjAzJTJGMjAyMi1NZW1iZXItTG9nb19XaGl0ZS5wbmclMjIlMjBib3JkZXIlM0QlMjIwJTIyJTNFJTNDJTJGYSUzRSUwQSUzQ2ltZyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGbm9ydGhzdGFyYXNzZXQuY29tJTJGd3AtY29udGVudCUyRnVwbG9hZHMlMkYyMDIxJTJGMDQlMkZTUkctbG9nby5wbmclMjIlM0UlMEElM0NpbWclMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRm5vcnRoc3RhcmFzc2V0LmNvbSUyRndwLWNvbnRlbnQlMkZ1cGxvYWRzJTJGMjAyMSUyRjA0JTJGQ29uZmx1ZW5jZS1nZW5lcmFsLWxvZ28ucG5nJTIyJTNF[/vc_raw_html][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]