2022 is Over! Our CEO’s Q4 2022 Letter to Clients

Fourth Quarter 2022

February 3, 2023

2022 is Over!

Not long ago, a man who lost his election for office in New Mexico hired four gunmen to threaten and intimidate the Democrats who had won various statewide elections. As we prepared this letter, there were mass killings in California and elsewhere, revelations of murder by police in Memphis, and a plethora of “natural” disasters that make things look bleak. In our role as your investment advisors, we must both ask the questions and respond to the challenges of this “polycrisis” world.

There was a time when it felt like we could identify something we wanted to change, think about various angles, come up with a strategy, and then begin the process of contributing to a solution. It is increasingly clear that problems are multi-layered with webs of intersection, complexity, and contradictions. Developing a values-based, long-term strategy while navigating financial challenges that are also intersectional and complex has been particularly difficult. Like other socially responsible investment managers, our performance lagged in 2022. Critics of incorporating environmental, social, and governance criteria into equity selection have had a heyday touting the phenomenal performance of oil and gas companies and some weapons manufacturers that have also outperformed. We discuss this more fully in the following sections.

We have all been running a marathon for three years: the twists and turns of the healthcare crisis, the vitriol stoked by a crazy man as president, and the ongoing struggles for acceptance, equality, equity, compassion, among communities of color, women, and LGBTQ citizens. While we strategize and carve out a stable path forward in a socially and financially turbulent time, we know that we must approach your portfolios with a clear-headed notion of where we want to be, why we want to be there, and what we want to accomplish. As you’ve heard me say before, we are so lucky at NorthStar to be a diverse team with a multitude of perspectives and a multitude of skills.

Remember that even in this challenging time, there are exciting murmurings of progress, like when the women of Kansas stood up for their right to choose and when the current President of the United States signed into law the right to equal marriage. Below, we will review 2022, how it impacted your portfolio, and our direction for 2023.

Economic and Market Update

With the recent end of the lockdown measures in China, it appears that COVID-19 pandemic restrictions are finally behind us (even with the virus carrying on with variants galore). The financial markets, however, are still reeling from the impact of monetary and fiscal policies implemented in response to the global health crisis, with 2022 marking the first time since 1941 that both bond and stock returns were negative for the year. It is easy to see last year as unusual, but the impact of the pandemic combined with the structural forces related to environmental and social factors have been in place for at least the last three years if not longer.

The lockdowns created a surge in demand for online shopping for everything from home gym equipment to binge watching on Netflix. The second phase was the gradual reopening during which consumers rushed to their favorite restaurants or finally decided to take that deferred vacation trip. This renewed increase in demand everywhere has been beneficial to the economic and job market recovery. However, at the same time, fewer workers were participating in the labor market due to health reasons, varying degrees of lockdowns globally, restrictive immigration policies, and lack of adequate childcare. The shortage of workers, especially in the US, forced a much-needed reset with several large retailers including Walmart and Target making public announcements of higher minimum hourly wage rates. Meanwhile, droughts, famines, and floods in different parts of the world have continued to escalate water, grain, and crop shortages. The final straw was Russia’s invasion of Ukraine in February 2022 which not only created a humanitarian and geopolitical crisis but also a spike in oil and gas prices as Russia is a dominant player in the global oil and natural gas markets. Hence the perfect “storm” of inflationary forces resulting in higher prices for a variety of items ranging from everyday groceries to airplane tickets. Unfortunately, low-income consumers have been disproportionately impacted, as basic living expenses such as food and rent are a larger percentage of a low-income family’s budget.

The Federal Reserve kept the federal funds rate close to 0% beginning in 2008 and extending into the pandemic. However, the steep and persistent rise in inflation with readings as high as 9% in June 2022, motivated the Fed to raise interest rates by more than four percent over nine months, the fastest increase since the 1980’s. This resulted in double-digit declines in prices of the bonds with maturities over five years. The increase in interest rates has not only created a viable alternative to stocks after more than a decade, but it also portends lower profits because of higher interest costs and potentially lower inflation-adjusted revenue for businesses if consumers pause on consumption. Inflation and rising interest rates combined with high equity valuations coming into 2022 made for a difficult year for stocks. After appreciating quite dramatically over the past three years, stock prices fell as conditions changed and euphoria faded.

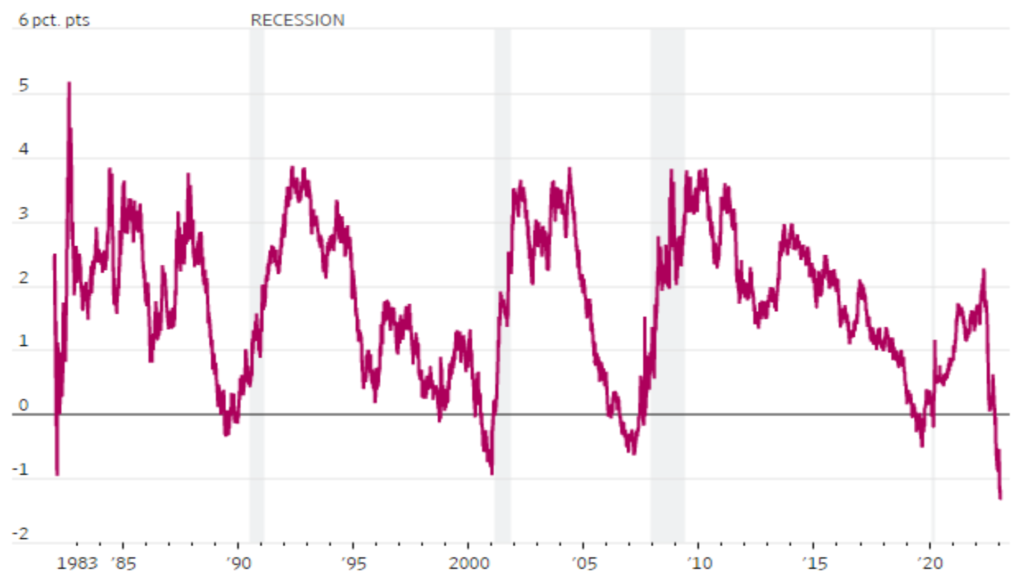

Coming into 2023, an economic recession is now widely anticipated as most market participants fear that the Fed’s actions will trigger a collapse in consumer demand. An inverted yield curve (where the ten-year treasury note yield is lower than that of three-month treasury bills) has served as a reliable indicator of previous economic recessions and has been flashing red since late 2022 as reflected in the chart below. Existing home sales declined 18% in 2022, and several leading technology companies have announced job cuts in the recent months. History suggests that the economy reacts to interest rates with a lag of about 12-18 months, implying that the impact of monetary tightening is far from clear yet.

10-Year Treasury Yield Minus Three-Month Treasury Yield, as of 31 Jan 2023

All of this is complicated by the deep divisions in our country, including the issue of the federal debt ceiling. There is no reason to believe that negotiations in Congress will proceed smoothly or on a timely basis to avoid partial or even more extensive shutdown of the government.

Outside the United States, the rivalry and political tensions between the US and China are cause for concern because China is a major trade and business partner with the US. China is looking to assert its leadership on the world stage, especially as it relates to technological innovation. China is also seeking to expand its physical boundaries and dominance over other Asian countries in the South China Sea, challenging Western norms of how countries should operate. In Europe, the Ukrainian people continue to defend their land almost a year after invasion by Russia. Even though NATO and the US continue to pursue diplomacy and deterrence in dealing with Putin, the conflict is yet to be resolved. All this means we should be prepared for another volatile year for both the bond and equity markets.

Outside Investments [1]

Amid the dueling forces of drought and flood, California, which provides nearly 50% of US-grown fruits, vegetable, and nuts, is in trouble. Therefore, so are we. The events that took place during the past few weeks in California are no longer a once in a lifetime or even once in a generation occurrence. Events like this are becoming the daily reality of an ever expanding and inextricably connected population that relies upon dependable food production, transportation, processing, and distribution, all of which have been and will continue to be subject to disruption and devastation that call into question whatever level of food security we enjoy. This fragility in a system upon which nearly all of us rely for sustenance cries out for attention.

The challenge as we see it is to ensure that those with financial means and personal and/or political power identify and implement an appropriate set of solutions that will enable us to collectively course correct.

Unfortunately, early signs are not promising. The Federal Reserve has been active in seeking solutions to alleviate inflation, including slowing the increase in food costs, which rose 13.5% in the past year. This is the highest increase in food costs in 43 years. While there are several core causes of inflation, we maintain that one of the primary drivers is the reality of confronting our planet’s ecological limits. Within California, the massive droughts over the past few growing seasons have ravaged crops, leading to supply disruptions, and increasing prices. Meanwhile, the head of the Federal Reserve, Jerome Powell, has been adamant that the Fed is “not a climate policymaker” while insisting (and apparently believing) that food-related inflation can be tamed with monetary policy. The Fed’s outright refusal to acknowledge the complexity and challenges caused and exacerbated by a disturbing tunnel vision that separates the “science” of economics from the science of our ecosystems leaves us with little hope that they will find the courage to address the shortcomings of their entrenched and increasingly inadequate approaches to solving our problems.

Recent years have unveiled the gulf between where our leaders and institutions are and where they must be. In times like these, we cannot have faith that they will get it right. Each of us must use whatever power and means we have access to in the aggressive pursuit of equity and regeneration.

Shareholder Activism Update

The end of 2022 officially rounds out the calendar year for our shareholder activism. While our 2023 activism is already well underway, every January we take stock of the full year’s engagements. Over the next quarter, we’ll be writing and releasing our next Social Change & Annual Report. In the meantime, we’d like to update you on our work and our vision for 2023.

In 2022, our most significant focus was on a project related to fair chance employment – the recruitment of justice-involved individuals (people with criminal records) into family-sustaining career paths. Throughout the past year, several NorthStar equity and activism staff members met with experts involved in various elements of supporting formerly incarcerated people, including: nonprofit partners working with justice-involved people to prepare them for post-incarceration employment; for-profit companies that provide consulting or recruitment services with the aim of encouraging companies to hire more people with criminal records; and a group of parole officers who helped us understand the issues that they see in their daily interactions. Among our many learnings, one of the most often repeated was the need to “change hearts and minds” – a reminder that socializing the issue of having a criminal record is one of the most important issues that companies need to do well.

With that knowledge, we revised our shareholder proposal on this issue to provide to companies clear and specific actions they can take to proactively recruit people with criminal records, including eliminating stigma and taboo. Importantly, we’ve pressed companies on the idea that this is not a charitable project – that people with criminal records comprise a diverse and vital talent pool that most companies have failed to take into consideration. Research shows that people who have been involved in the criminal legal system can be extremely loyal, hardworking, and more productive even compared to their counterparts who do not have criminal records. In 2022, we engaged Microsoft on this issue and have so far filed this proposal at Adobe, Badger Meter, IDEX Corp, and Xylem for 2023 (with likely more to come).

Our two years of engagement at Microsoft have yielded an important change. In our dialogues this past fall, the company shared that it was developing a fair chance cohort for its apprenticeship program. This is an important step forward for Microsoft – they will be intentionally recruiting justice-involved individuals into their apprenticeship program that may lead to direct-hire opportunities at Microsoft. They also shared that, as they are developing this cohort model, they are working with an expert consultancy to ensure that they have the support structures in place to help these talented apprentices succeed. In the end, we couldn’t withdraw our proposal at Microsoft because they refused to align this project with their DEI goals by starting to analyze whether racial equity is being achieved in their fair chance hires and in the upcoming “reentry cohort”; however, this step forward is meaningful and allows us to use this example in other engagement dialogues.

In addition to our upcoming Social Change & Activism Annual Report, we’re working on a position paper that details our research in this area and shares our thought leadership on best practices. We hope to share both documents with you this spring.

Also, for 2023, we have filed shareholder proposals at portfolio companies on systemic racism in corporate culture, equal shareholder voting, and human rights due diligence in the supply chain. Engagements are underway for all these proposals, so we should be able to report out more in our next quarterly letter.

Sincerely,

Julie N.W. Goodridge

The forecasts, opinions, and estimates expressed in this report constitute our judgment as of the date of this letter and are subject to change without notice based on market, economic, and other conditions. The assumptions underlying these forecasts concern future events over which we have no control, and may turn out to be materially different from actual experience. All data contained in this letter is from sources deemed to be reliable, but cannot be guaranteed as to accuracy or completeness. All investments are subject to risk, including loss of principal. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

FOR INFORMATION PURPOSES ONLY

This information includes a discussion of a number of companies and other financial market and social events. These opinions are current as of the date of this publication but are subject to change. The information provided herein does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security.

[1] Outside Investments are privately placed with various types of entities, as described above. In addition to the risks of equity, (which include, but are not limited to, changes in revenue, margins, earnings, dividends, cash flow, balance sheet, leverage, liquidity, solvency, legal matters, negative publicity, brand image, and general market volatility) and the risks of fixed income investing (such as credit risk, interest rate changes and the yield curve, inflation, default, monetary policy changes, government instability, and other risks), Outside Investments are typically illiquid.