Our CEO’s Q1 2024 Letter to Clients

April 1, 2024 First Quarter 2024

Our View

Last quarter we reflected on the polarization we are experiencing around the globe and the current tendency to reject multiple and conflicting realities in favor of binary “this or that” solutions. Our view is that dependence on binary, good versus evil thinking and behavior is intrinsically flawed. Recognizing and embracing complexity is uniquely human, and it is a muscle that needs to be exercised. Even our work in portfolio management and investment selection involves knowing and embracing a myriad of client needs–loans to kids, perceived risk, uneven grant funding, humanitarian responses, urgent needs for cash, and interpreting the risk to portfolios during an election year! Each client is unique. We work to bring an openness to individual client perspectives and needs in the context of the scary world around us, and we research and strategize about how to bring this together for you. We begin our work thinking about how no public company is 100% socially responsible, and we take it from there.

We are all focused on this year’s election—and rightly so. It is not a “normal” election in which two or more generally good people differ on matters of policy. Rather, this election promises to be a watershed moment for the United States with ripple effects throughout the world. Our current political, social, and ecological challenges are indeed complex, and, once we sort and prioritize and analyze, we believe the choice is clear. This doesn’t mean that choosing the current administration is a cure-all or an end to the ever-evolving sense of justice we often reference. It’s critical that we consider our options in context and choose what feels clear and necessary. The current administration has made choices that many of us disagree with–whether the most progressive or conservative among us. Some of these decisions have had devastating humanitarian consequences, and some have been offered in the hope of solidifying protections we have watched the Supreme Court wipe away. While we most certainly cannot condone every one of the current administration’s decisions, it is clear to us that the alternative would be dangerous and damaging. The choice in this complex world is clear and simple.

Update on Economic Outlook and NorthStar’s Strategy

Q1, 2024: Resilient US Economy

The recent economic data continues to paint an overall picture of a healthy economy supported by the addition of ~829,000 jobs in the first three months of the year and continued, albeit bumpy, progress on inflation. Quarterly earnings reports from large US listed corporations (S&P 500) exceeded market expectations and are forecast to increase by 8.5% in 2024. Consumer spending remains robust as household net worth for older and wealthier Americans is at peak levels with help from strong performance of financial markets[1]. Unfortunately, this concentrated wealth effect continues to obscure the rise in financial stress for younger and lower income people.

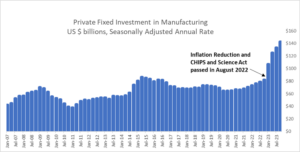

As discussed in our previous quarterly letters, we believe that the job market has remained strong due to the lower availability of job seekers. Lower labor participation can be attributed to a wave of retirements for baby boomers, more Americans choosing to pursue flexible “gig” jobs and slowing population growth[2]. Lower immigration during 2020-2022 also temporarily impacted the availability of workers, but that appears to have reversed. On the demand side, there is more demand for workers in the healthcare and services sectors. In addition, the Inflation Reduction Act and The CHIPS Act have led to a resurgence in manufacturing activity and jobs in the US.

Chart 1: US Private Fixed Investment in Manufacturing

Source: Economic Research Federal Reserve Bank of St. Louis, April 8, 2008

Meanwhile, as the economy remains on a strong footing and inflation appears to be on a downward trajectory, there is little need for the Federal Reserve to lower short-term interest rates. As the bond markets picked up on this, the yield on the 10-year government bond increased from 3.87% at the start of the year to 4.3% as of March 28, 2024.

2024 Elections and Potential Implications for NorthStar Equity and Fixed Income Portfolios

As rosy as the above data and commentary sound, we would be remiss if we did not examine the potential implications of the November US elections. Although media attention is focused on the presidential rematch of Biden vs. Trump, one-third of the Senate and every seat in Congress is also up for election. The decision should be an easy one when democracy and individual freedoms are on the ballot, but the current state of polarization in our country lends itself to a high degree of uncertainty and higher volatility in the financial markets.

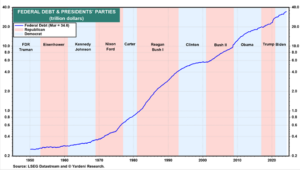

Markets may be jittery leading up to November as the noise from political rhetoric and election polls gets louder. However, in past elections, once the results are known, stocks have usually gained through the end of the year as economic and inflation trends tend to be the primary driver for market returns (Chart 3), though the sectors which perform well may depend on who wins the election! Data suggests that there is no clear pattern or persistence for sector returns. However, under a Trump presidency, we would expect to see a clear risk to clean energy and renewable projects in favor of subsidies and tax incentives for domestic oil and gas production[3]. Both Biden and Trump are proponents of rebuilding a US manufacturing base, and similarly both are in favor of negotiating lower drug prices for seniors. Both parties face a serious long-term problem related to high budget deficits and government debt and the resulting almost one billion dollars in annual interest costs to service that debt. The Biden administration’s answer is to raise taxes on individuals earning over $400,000 and let the tax cuts initiated in 2017 under the Tax Cuts and Jobs Act (TCJA) expire. Trump is likely to extend those tax cuts by gutting key elements of the Inflation Reduction Act focused on climate transition and resilience and reducing funding for key social programs[4].

Chart 2: Presidents and the Stock Market Performance

Chart 3: Presidents and the Federal Debt

As we have often noted, our approach to navigating these treacherous moments in our political environment is to ensure that we understand your financial needs and objectives and establish an appropriate target asset allocation and liquid reserves. Second, we remain disciplined and committed to strategic asset allocation, maintaining appropriate diversification, and managing risk.

Adding higher yielding bonds to portfolios

Since 1980, interest rates have declined, but now that cycle is reversing. We believe there is a high probability that interest rates will remain at these or higher levels over the mid-to-long term, as our government and others will need to fund Social Security, Medicare, and Defense programs while grappling with challenges related to ecological limits and socio-political upheaval.

Higher interest rates provide an opportunity to boost yield in fixed income portfolios. Where appropriate, we will continue to diversify across duration and add government bonds in the one to ten-year maturity range to our clients’ portfolios. We believe that bonds in this maturity range offer an optimal combination of flexibility, higher income returns, and stability for the portfolio.

High quality stocks with low debt can still provide long-term growth

Over the mid-to-long term, companies with low financial debt and that make products or sell services that are beneficial to human life and that solve or mitigate some of the most pervasive problems of our time should continue to thrive. We focus our research on companies providing solutions and products to cope with:

- Ecological Limits: Our planet’s resources are increasingly under threat from ecological imbalances and decades of extractive growth.

- Aging and changing demographics: The world’s population aged 60 and over is growing faster than all younger groups and is expected to reach 1.4 billion by 2030, up from 1 billion in 2020.[5]

- Leveling the playing field: Digital transformation and new business models are enabling small businesses and entrepreneurs to compete with big business.

We aim to own and add stocks that offer competitive returns and diversification while also providing opportunities to create the greatest impact by changing corporate behavior via our shareholder activism work.

As a refresher, our investment strategy for the global equity portfolio involves significant independent research into each company’s growth prospects and financials combined with diligently examining the ethics of management and company behavior. The resulting portfolio, we believe, is more resilient, sustainable, and stable because of our broad-based focus. In addition, we follow our systematic quarterly rebalancing strategy in which we trim individual stocks that are well past their target weights and reallocate to stocks that are under their target levels. Of course, past performance is not an indicator of future performance!

Outside Investments 6

We’ve mentioned the upcoming elections earlier in this letter. Among the supposed agenda items in DJT’s long list of “what I’ll do when I’m president” is a desire to do away with the CDFI Fund, which is the part of the US Treasury that qualifies and funds Community Development Financial Institutions in the United States. While this proposal didn’t get far in his previous administration, we note it as a possibility. Even if funding is withheld, the CDFI Fund is just one of many important funders, including banks (fulfilling their obligations under the Community Reinvestment Act, corporations that support communities, foundations and endowments (sometimes making program-related investments), and individuals. Promises like this, whether they materialize or not, are symbolic of a much larger commitment to deconstruct social benefits and reward the already wealthy.

Shareholder Activism Update

The 2024 spring proxy voting season is in full swing with seven of NorthStar’s proposals going to a vote of shareholders as referenced below. Continuing our commitment to creating positive social change at our portfolio companies, we re-filed proposals from the prior year and introduced our fair chance employment proposal at A.O. Smith. We will continue to update you on the voting results of our proposals as they become available.

| PROPOSAL | COMPANY |

|

Fair Chance Employment (proactive recruitment of people with arrest or incarceration records) |

§ Adobe § A.O. Smith § Badger Meter § IDEX Corp.

|

|

Equal Shareholder Voting |

§ Alphabet § Meta Platforms

|

|

Human Rights Due Diligence in the Supply Chain

|

§ TJX Companies |

In the US, 70 million Americans or one in three adults have a criminal record. Each year 700,000 people are released from incarceration, but, due to the thousands of barriers they face outside of prison, upwards of 75% are unemployed within a year and 67% end up returning to the prison system within three years. The unemployment rate for those with criminal records is 27%, which is five times the national rate. This is particularly unjust considering 81% of business leaders and 85% of Human Resources professionals believe formerly incarcerated people perform their jobs as well if not better than those without criminal records. Corporations can and should play a vital role in lowering these hurdles by being more inclusive.

In March, we hosted a webinar focused on fair chance employment—the intentional recruitment of justice-involved individuals (people with criminal records) into family-sustaining career paths. Invited attendees included clients and the corporate teams of the portfolio companies at which we filed fair chance employment proposals this season. Last spring NorthStar successfully withdrew our shareholder proposal at Xylem given the company’s strong commitment to launching a groundbreaking fair chance employment pilot program. We invited three people engaged in this project to speak with us at the webinar: Todd Boyle, VP of HR, Global Enabling Functions and DEI at Xylem and leader of the initiative at the company; Matt Joyce, Partner at Envoy, a social impact advisory firm engaged by Xylem to implement the program; and El Sawyer, an acclaimed filmmaker known for his documentary “Pull of Gravity,” who, in collaboration with the U.S. Department of Justice, has become a catalyst for change within justice systems. The webinar showcased the varying pathways companies can take to incorporate fair chance employment practices in their organizations, debunk stigmas, and highlight the benefits to their peers.

We invite you to watch a replay of the webinar here: Untapped Potential – A Fair Chance Employment Roadmap.

Sincerely,

Julie N.W. Goodridge Nimrit Kang

Founder & Chief Executive Officer Chief Investment Officer

Important Disclosures

Advisory services offered through NorthStar Asset Management, Inc., a registered investment adviser. Registration does not imply any level of skill or training. This communication is for educational purposes only. It is neither an offer to sell nor a solicitation of any offer to buy any securities, investment products, or investment advisory services.

This material may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual results will not be materially different from those described here.

Past performance is no guarantee of future results. All investment portfolios carry risk, including the risk of loss. No assurances can be given that NorthStar will attain its investment objective or that an investor will not lose invested capital.

This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or as a recommendation of or solicitation of any particular security, strategy, or investment product. The forecasts, opinions, and estimates expressed in this report constitute our judgment as of the date of this letter and are subject to change without notice based on market, economic, and other conditions. The assumptions used in our forecasts concern future events over which we have no control and may turn out to be materially different from actual experience.

NorthStar does not provide legal or tax advice, and nothing contained in these materials should be taken as legal or tax advice. Although NorthStar believes the data presented here to be reliable, we do not guarantee the accuracy of third-party data. Links to third party sites are provided for your convenience and do not constitute an endorsement. These sites may not have the same privacy, security or accessibility standards.

Indices are presented herein for illustrative and comparative purposes only. Such indices may not be available for direct investment, may be unmanaged, assume reinvestment of income, do not reflect the impact of any trading commissions and costs, management fees, or performance fees, and have limitations when used for comparison or other purposes because they, among other things, may have different strategies, volatility, credit, or other material characteristics. In considering performance results discussed here, prospective clients should note that equity portions of individually managed accounts may differ from the results shown here because of client-specific restrictions, client circumstances, client legacy positions, different fee and expense structures, actual trading, tax considerations, and other reasons.

[1] Federal Reserve Financial Accounts of the United States, https://www.federalreserve.gov/releases/z1/20240307/html/recent_developments.htm

[2] Federal Reserve Bank of San Francisco, https://www.frbsf.org/research-and-insights/publications/economic-letter/2023/08/how-far-is-labor-force-participation-from-its-trend/

[3] https://www.eiu.com/n/biden-vs-trump-key-policy-implications-of-either-presidency/

[4] https://www.theatlantic.com/ideas/archive/2024/03/trump-2017-tax-cuts-2025-expiration/677846/

[5] Source: United Nations Department of Economic and Social Affairs, World Population Prospects 2022

[6] Outside Investments are privately placed with various types of entities, as described above. Privately placed investments generally carry higher risk. In addition to the risks of equity, (which include, but are not limited to, changes in revenue, margins, earnings, dividends, cash flow, balance sheet, leverage, liquidity, solvency, legal matters, negative publicity, brand image, and general market volatility) and the risks of fixed income investing (such as credit risk, interest rate changes and the yield curve, inflation, default, monetary policy changes, government instability, and other risks), Outside Investments are typically illiquid. More information on the risks of Outside Investments may be found in our ADV 2A brochure, located at: https://files.adviserinfo.sec.gov/IAPD/Content/Common/crd_iapd_Brochure.aspx?BRCHR_VRSN_ID=854692