Our CEO’s Q1 2023 Letter to Clients

First Quarter 2023

May 5, 2023

Our View

There was a moment in our recent history that felt like real progress was happening—for women, people of color, LGBTQIA+ people, and many others. Perhaps the backlash we’re currently experiencing shouldn’t be surprising. Nevertheless, it can feel highly disappointing and frightening.

The term “sexual harassment” was coined in feminist circles in the early 1970s and related to work environments where women consistently found themselves intimidated or outright harassed by male co-workers. Despite regulatory and private sector efforts to curb harassment in the workplace, our cultural norms now seem to tolerate, if not outright encourage, sexual harassment and intimidation from political candidates, the media, Supreme Court appointees, and many others. Since the emergence of the Trump phenomenon, harassment and intimidation of all types feels like the status quo, with special animosity toward BIPOC, LGBTQIA+, and immigrant communities.

NorthStar’s five pillars—Race and Gender, Economic Equality, Human Rights, Environmental Justice, and Corporate Governance arose from our awareness and experiences of animosity and threats to basic rights in our communities. A case in point: after “winning” on reproductive rights (a huge setback for women), the Republican Party realized they might lose some of their supporters. According to a recent New York Times article, rather than backing off, they found a new common thread of social discontent to keep “the base” together by stirring up rage over transgender people. What a strange way to bring people together! It is certainly an antithetical approach to building community and generating a common sense of purpose and wellbeing.

Along with hatred (and fear and resentment) of trans people, these same players have decided to demonize and restrict the incorporation of environment, social and governance (ESG) criteria into the assessment of investment opportunities. The winners of the “conservative” effort to unite people based on hatred, ignorance, and (most likely) fear are gender transition and expression (broadly) and ESG investing! Fighting and polarization are hazardous diversions at a time when community, common goals, and concern about all our futures should be front and center.

So how is it that we have come to this point in our society? Why are issues of reproductive rights, gender expression, equity for all, and concern for the environment so horrible that they need to be dismantled and destroyed? Maybe the answer is simple. While it is tempting to sink into despair, a more nuanced perspective is that these are last-ditch efforts to preserve a way of living, working, and knowing that is threatened by gender and racial empowerment, the reality of ecological limits, and a world of new and strange technologies along with increasingly strong reminders that our capitalist system has since inception depended on enslavement and displacement. Demonizing change, difference, and an evolving sense of justice serves to engage those who are facing loss after having had unacknowledged advantages, privileges, and access to wealth. A desire to return to the past is so much easier than revisioning a new path forward that would serve the greater good (but might require self-reflection and maybe even a bit of concession).

Looking backward to predict future performance is a big no-no in the financial world. While we find fault with lots of aspects of our financial system, this is one rule we wholeheartedly support. It’s tough to face uncertainty, but it’s necessary and even exhilarating.

Economic Update

Since early 2022, the Federal Reserve Board (“the Fed”) led by Chairman Jerome Powell has embarked on a rapid spate of interest rate increases in an attempt to quell high levels of inflation. We agree with rapper Cardi B that $7.00 for a head of iceberg lettuce is indeed extreme compared to $1.99 pre-2022. However, we remain unconvinced that raising interest rates is the appropriate response to a crisis that has been in the making for years, if not decades. Instead, we are concerned that Fed’s use of a blunt instrument at a time when the world needs a very thoughtful and nuanced approach will cause more harm.

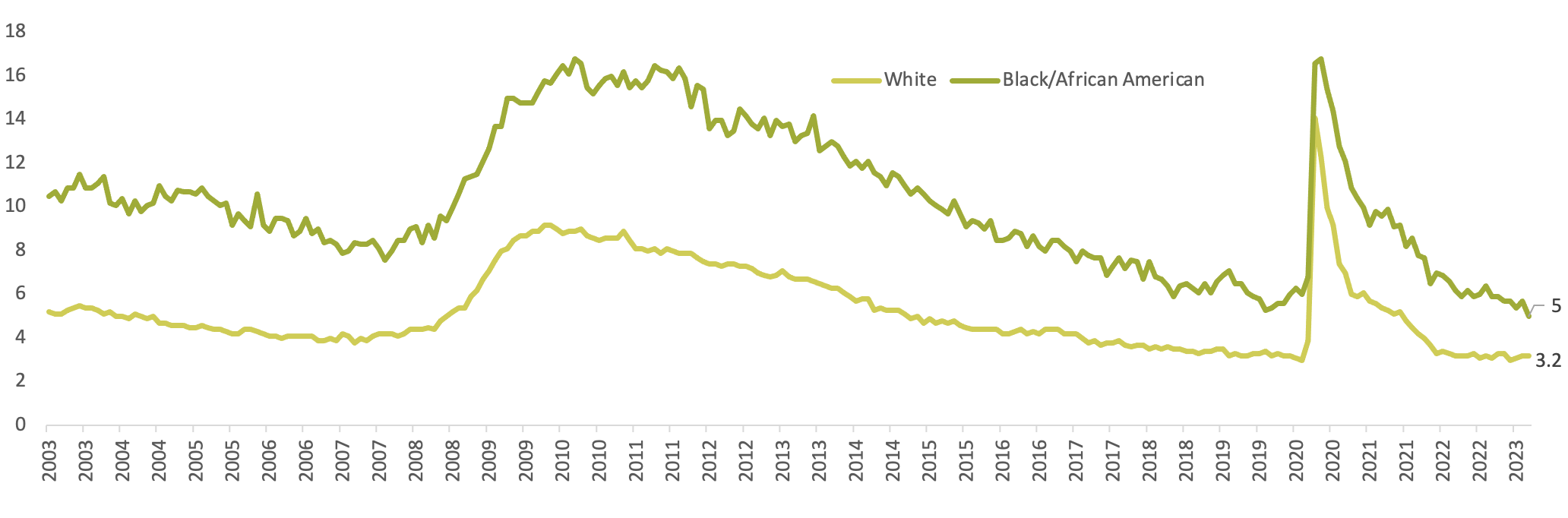

The Fed is reacting in part to employment data (see below). The logic is that a stronger labor market will result in wage increases and hence higher inflation. The Fed’s aggressive response is an attempt to connect the dots, assign causality, and then use the only tool at their disposal to curb inflation. This is indeed a blunt instrument that may actually work at cross purposes to societal goals such as broad-based labor market participation, jobs for women and people of color, and increases in real earnings (see below).

US Unemployment Rate, Seasonally Adjusted Percentage

Source: Bloomberg and Bureau of Labor Statistics, April 18, 2023

Labor Participation, 16 years and Older %

| Mar-03 | Mar-13 | Mar-23 | |

| White Males | 74.1 | 70.3 | 68.3 |

| Blacks/African American Males | 66.7 | 64.1 | 67.5 |

| Females | 59.7 | 57.2 | 57.1 |

Source: Bloomberg and Bureau of Labor Statistics, April 18, 2023

Real Average Hourly Earnings

| Mar-03 | Mar-13 | Mar-23 | |

| All Employees | $10.25 | $10.99 | |

| Production and Nonsupervisory workers | $8.48 | $8.74 | $9.63 |

Source: Bloomberg and Bureau of Labor Statistics, April 18, 2023

While the Fed’s control is strongest with the fed funds rate (overnight bank lending rate), there are ripple effects. For example, 30-year mortgage rates recently hit 7%, and banks are tightening their lending policies, making it challenging for low- and middle-income families to buy or rent homes.

| Mar-03 | Mar-16 | Mar-23 | |

| 30-year Mortgage Rates* % | 5.53 | 3.67 | 6.81 |

| Median Price Existing Single-Family Home | $161,500 | $214,800 | $367,500 |

| Median Monthly Principal and Interest payment | $672 | $832 | $1,827 |

Source: Bloomberg, National Association of Realtors, * Bankrate.com US Home Mortgage 30 year Fixed National Average April 18, 2023

The recent regional bank crisis, triggered by the failure of the Silicon Valley Bank and Signature Bank, is yet another example of the unintended consequences of ill-suited policies. Depositors are fleeing smaller banks for the safety of large money center banks, which may eventually lead to a void in financial services in underserved communities.

Rather than targeting a broad-based slowdown in the economy and the labor market, which would disproportionately impact people of color, perhaps a tiered approach is warranted at this time—investing through fiscal policy in affordable housing and regenerative non-fossil fuel infrastructure, for example, while removing the incentives that fuel speculation and exploitation.

Outside Investment[1]

During Black Farmer Fund’s recent webinar, one of the panelists remarked on a uniquely American approach to capitalism: “socializing losses and privatizing profits.” Despite stated commitments to free markets, our system tends to rescue big but often bad actors by transferring costs to the general population, while allowing smaller, less powerful businesses and individuals to fail and navigate their fallout with little assistance. Not only is this dynamic inequitable and unfair, but we believe it often introduces greater fragility into our systems as individuals and businesses take on additional risk perhaps knowing they won’t bear the full cost. This dynamic is so common it has a term: moral hazard.

We have seen repeated examples throughout our economic history of how excess risk taking can destabilize our systems. Earlier this year Silicon Valley Bank (SVB) faced collapse and put $175 billion in deposits at risk. It was quite something to observe. The very same bankers (including senior leaders at SVB) who drove the bank into failure had lobbied successfully for looser regulations following the Great Recession. These same professionals relied upon, and in fact demanded, the government’s swift intervention. In the case of SVB, there were several converging factors that precipitated its demise, including the fact that looser regulations allowed the bank to take on irresponsibly high levels of interest rate risk in pursuit of quick profits. It is also quite possible that the loans made by the bank to Silicon Valley start-ups and other companies were not as solid as they might have been assumed to be. We do know, though, that the headlines have not been filled with news that the people responsible for these decisions have been required to forfeit their bonuses!

Meanwhile, seldom is this level of grace and assistance granted to the communities most in need. BIPOC and low- and moderate-income communities often face additional scrutiny and hurdles as they are deemed overly risky despite evidence to the contrary. It turns out, unsurprisingly, that there are multiple systems of capitalism in this country: one for the big and powerful and another for those left to scrape by. With our Outside Investments, we meet people every day who not only advocate for new systems but successfully implement independent and differently powered solutions. The sizes of these initiatives are small in the context of the global economy, but they are huge in their vision, dedication, and courage.

Shareholder Activism Update

Nearly 1 in 3 Americans possess a criminal record, which is roughly the same percentage as those with a college degree.[2] Once someone has a criminal record, especially if they are Black or Brown, barriers to employment escalate after release from prison. While at least 30% of our country’s residents have been dragged through our criminal legal system (with all its flaws and embedded systemic discrimination), our society has created an “us vs. them” mentality – the “law abiding” vs. “criminals.” This is an unfair and muddied dichotomy that we, at NorthStar, believe was built with racism at its core. (Read more about our perspective on the links between slavery and modern incarceration in our 2018 paper on prison labor.) Corporations have long been key players in the criminal legal system through their financial support of various ballot initiatives, politicians, and strategic organizations, so NorthStar believes that they also must be held accountable for their role in undoing the historic harms of the legal system. For us, this takes the form of shareholder proposals asking portfolio companies to take proactive actions to improve recruitment and reduce bias in their hiring programs for people with criminal records.

For almost two years, NorthStar has been interviewing a range of experts related to incarceration, reentry, parole, and fair chance employment in order to determine company best practices in recruitment, hiring, and support of fair chance employees. We’re now actively engaging companies in your portfolio to push back on the many hurdles and prejudices that people face after interacting with the criminal legal system. In our work, we press companies to get past the “us vs. them” mentality and recognize that fair chance hires comprise a valuable talent pool that can solve company challenges like labor pool constraints and the persistent dearth of diversity.

| NorthStar Proposals – Spring Company Meetings | |

| Company | Proposal |

| Adobe | Fair chance employment (proactive recruitment of people with arrest or incarceration records) |

| Alphabet | Equal shareholder voting |

| A.O. Smith | Systematic racism in culture |

| Badger Meter | Fair chance employment (proactive recruitment of people with arrest or incarceration records) |

| Digital Realty | Systematic racism in culture |

| IDEX Corp. | Fair chance employment (proactive recruitment of people with arrest or incarceration records) |

| Meta Platforms | Equal shareholder voting |

| TJX Companies | Human rights due diligence in the supply chain |

Since 2017, April has been proclaimed “Second Chance Month” – a national recognition that shines a light on challenges related to reentry from prison to society. (At NorthStar, we use the term “fair chance employment,” rather than “second chance” because we believe that everyone deserves a fair chance to succeed, not just a second chance.) For the 2023 spring proxy season (when most public companies have their annual meetings), NorthStar has eight proposals going to a vote of shareholders. As you can see on the chart to the right, several of these proposals are building momentum for our campaign on fair chance employment. During this year’s Second Chance Month, our proposal at Badger Meter was presented by Dant’e Cottingham, a community organizer of EXPO (Ex-incarcerated People Organizing) at the company’s annual meeting in Milwaukee, Wisconsin. As someone personally affected by the criminal legal system, we are honored that Mr. Cottingham shared his story and supported our proposal in front of Badger Meter’s company management, board, and shareholders in attendance. Read Dant’e’s speech on our website here. We look forward to further developing our fair chance employment campaign over the summer and next fall.

We are also thrilled to report that we were able to withdraw our fair chance employment proposal at Xylem, a water solutions technology manufacturer in your portfolio. Through our shareholder engagement, Xylem has committed to creating a pilot program at two manufacturing sites, some of their most diverse locations, intended to proactively recruit people with criminal records. The company also committed to partnering with an expert consultant in planning the program and to examining its hiring data from this program for racial bias. As we continue to engage companies in your portfolios to encourage responsibility and proactive action, our success at Xylem is an example we can hold up to other companies as a genuine commitment to progress.

Sincerely,

Julie N.W. Goodridge Nimrit Kang

Founder & CEO Chief Investment Officer

The forecasts, opinions, and estimates expressed in this report constitute our judgment as of the date of this letter and are subject to change without notice based on market, economic, and other conditions. The assumptions underlying these forecasts concern future events over which we have no control, and may turn out to be materially different from actual experience. All data contained in this letter is from sources deemed to be reliable, but cannot be guaranteed as to accuracy or completeness. All investments are subject to risk, including loss of principal. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

FOR INFORMATION PURPOSES ONLY

This information includes a discussion of a number of companies and other financial market and social events. These opinions are current as of the date of this publication but are subject to change. The information provided herein does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular security.

_______________________________________________________________________

Footnotes:

[1] Outside Investments are privately placed with various types of entities, as described above. In addition to the risks of equity, (which include, but are not limited to, changes in revenue, margins, earnings, dividends, cash flow, balance sheet, leverage, liquidity, solvency, legal matters, negative publicity, brand image, and general market volatility) and the risks of fixed income investing (such as credit risk, interest rate changes and the yield curve, inflation, default, monetary policy changes, government instability, and other risks), Outside Investments are typically illiquid.

[2] https://www.brennancenter.org/our-work/analysis-opinion/just-facts-many-americans-have-criminal-records-college-diplomas